📈(NEW)INFLATION REPORT TOMORROW

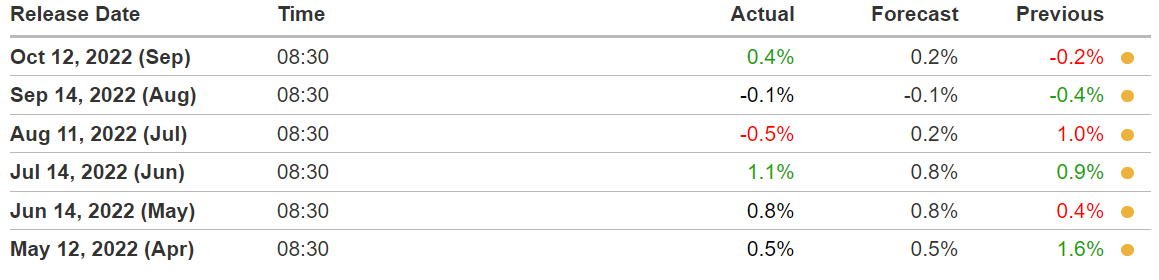

PPI was released today and came in higher than expected. The expectation was higher than the previous month and still was double the expectation. The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services. This is calculated by receiving data from businesses. After the July 14th reading the PPI month over month came in negative for the next two months. This showed a drop in cost. Today’s estimate of .2% was doubled to .4% . This coupled with last weeks non farm payrolls and unemployment number show that inflation may not have peaked. As you can see from the graph below the last two reading prior to today. were negative.(graph from investing.com)

It is one thing for us to accept a slight move higher in the forecast. It is another to go from negative to double the forecast. This raises questions about tomorrow’s inflation report.

CPI is due out tomorrow at 8:30 am. Below are the forecasts and previous. To be clear all three need to come in lower. If any of the numbers come in higher than previous we will see the indexes sell down. Should we see larger than expected declines we can see a relief rally.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.-bls.gov

In regard to the indexes we are being driven by a massive macro event. The unprecedented fed rate hikes are causing havoc all over the world. The hikes are causing the dollar to rise(orange), 10 year yields to rise(blue), and the stock market(green) to sell off. The graph below is from March the first fed rate hike. Since that period in time the dollar is up 17.9% and the SP500 is down -16.58%. It is almost a one for one correlation. This will exist in some form until the fed policy slows down.

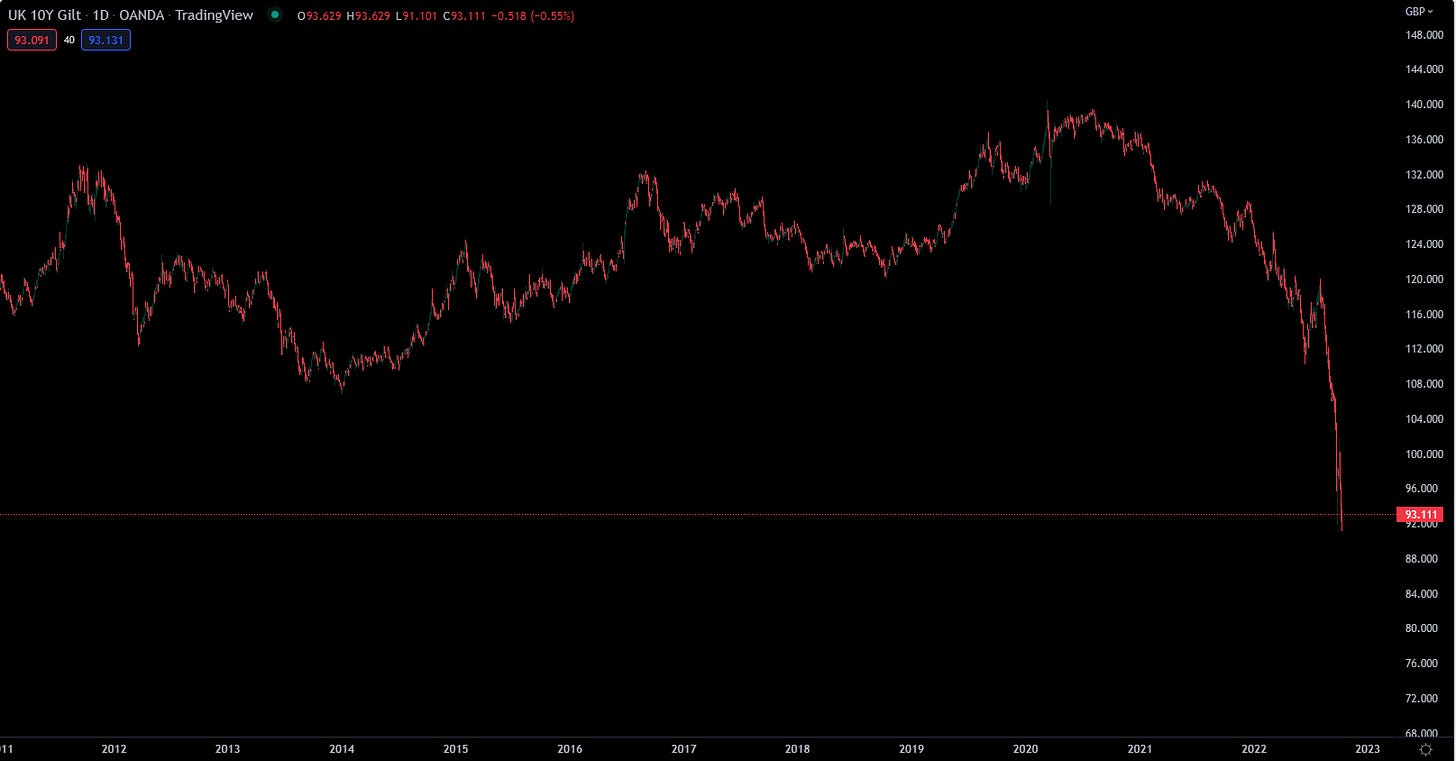

Below is an example of what an aggressive fed policy can do. The U.K. Gilt(10 yr treasury) is down to the lowest level in 20 years. The graph below shows that any bond holder of the past 10 years is down significantly. This oversized sell off is causing U.K. pension funds to have margin calls which in turn leads to selling bonds which in turn leads to margin calls. Get it? It’s a self fulfilling prophecy. The U.K. Government is currently buying bonds in the open market but said they are going to stop. Their actions are changing rapidly. This creates another issue. If you are a pension fund and you know your backstop(U.K. Gov’t) is going to stop buying they might accelerate selling which causing more damage.

All banking is now global banking. We saw this in 2008. We learned about counter party risk. Counterparty risk is the probability that the other party in an investment, credit, or trading transaction may not fulfill its part of the deal and may default on the contractual obligations. If the risk increases the bonds drop in value. The cost to insure the bonds skyrockets. All of these can have global banking repercussions. Yesterday Janet “inflation is only temporary” Yellen stated in an CNBC interview "I think the US economy continues to do well.” Only to answer today when pressed a little differently:

For now we continue to monitor the indexes, key bond markets and core macro data. What we do not know is how the U.K. bond and currency crisis will affect the rest of the global banking system. Its best to watch this closely. Between the current global uncertainty, CPI tomorrow I have put everything usually in charts in tonight’s video. I go over the CPI and PPI extensively. I cover what stocks or bear ETFs look most attractive depending on the CPI reading. It’s in depth and concise. We will go back to posting chart next Wednesday just in time for earnings season.

Preview the Trading Community CLICK HERE

EMAIL: Arete@aretetrading.net

Trade to Win!