PPI Results

Yesterday we received PPI results and the market initially jumped on the news, only to sell off at the end of the day in anticipation of CPI.

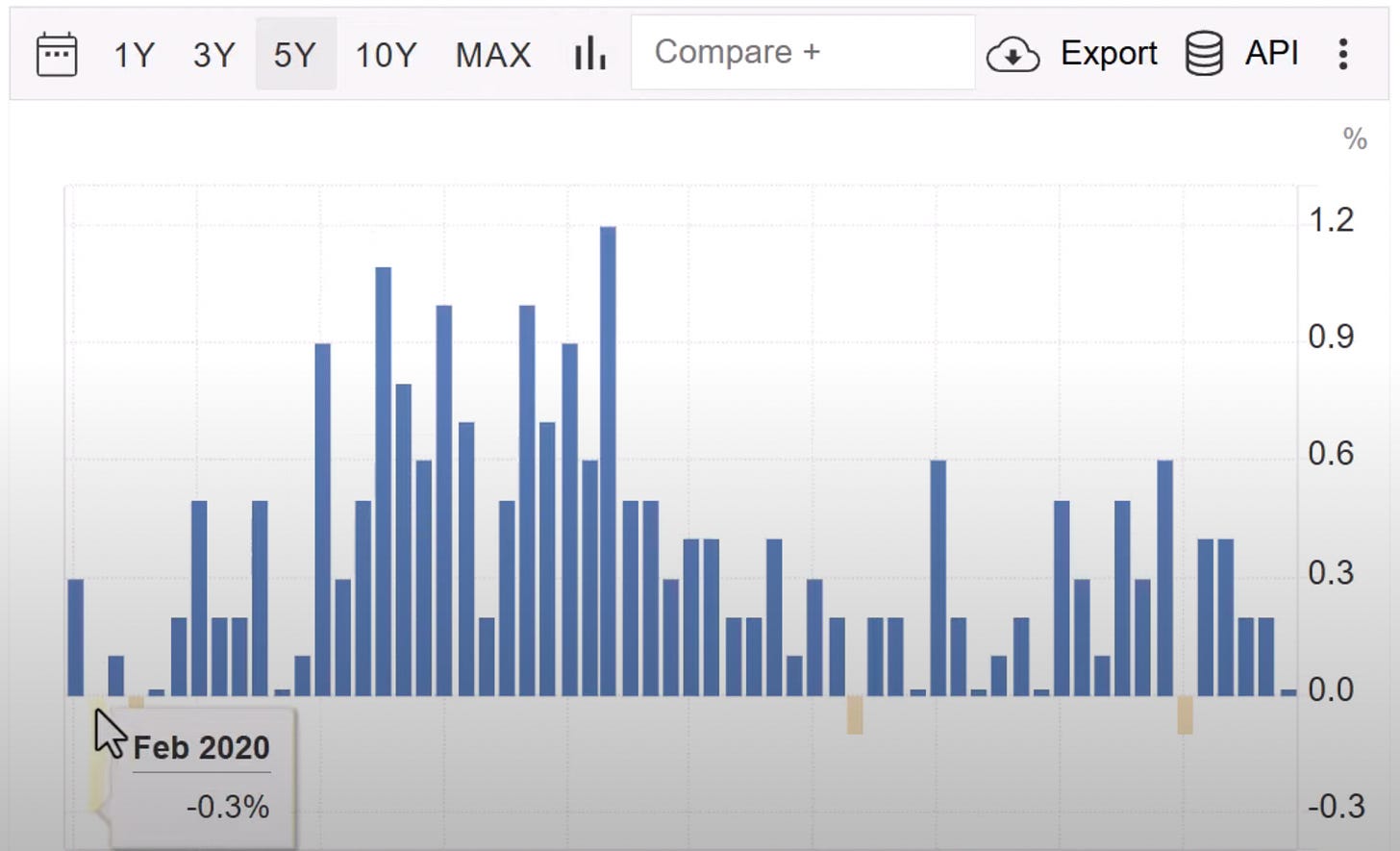

PPI month-over-month came in at 0.2% vs. expected 0.3% and core PPI month-over-month came in at 0.0% vs. expected 0.3%. This was unexpected.

The market took this as good news, as it shows that inflation for producers was lower than expected.

However, the core PPI coming in at 0.0% could signal a lack of pricing power and could be a concern.

You can see that it is rare to register a number this low, and the last few times it has happened were around pandemic levels.

This could be a possible explanation as to why the market sold off at the end of the day in addition to selling leading up to CPI.

CPI On Deck

CPI numbers release at 8:30 AM ET this morning. Here’s what you need to know:

Month-over-month they are telling us that they expect the inflation rate to hold steady from our last reading at 0.3%.

While this would be great, many traders (including me) are skeptical of this.

Tracking the price of oil and gasoline over the past month, you can see that prices have increased significantly. The white lines demark CPI periods:

When you see oil and gasoline prices rising, it usually signals that CPI will also come in higher, but we will have to see how the number comes in.

The market has changed and I’ve been adapting my trading style to take advantage of what the opportunities the market is providing us.

To see how I am trading right now, watch this clip: