Small Caps Breaking Out

Small cap stocks have been leading the market recently - and the Russell 2000 Index is now breaking out of a multiyear base.

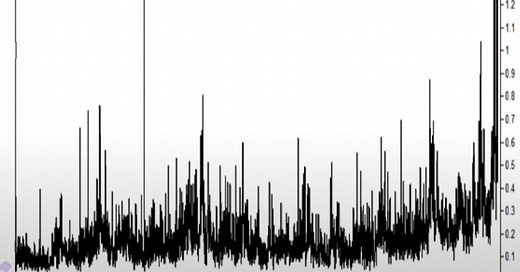

We are seeing a ton of call volume flowing into the IWM - the most since 2008 (see below).

You need to be focused on small caps right now, and I’ll share the specific sectors that look the best.

Sector 1: Biotech

Biotech has been a leader for the last two months after a rough year prior to that.

We are seeing a dramatic increase in the buyouts of biotech companies that is bringing the sector higher. This is because as rates come down, it is cheaper for deals to be made.

LABU is the 3X ETF for biotech and is a name that you should be watching.

Sector 2: Semiconductors

Semiconductors have also been seeing large amounts of buying.

The SOXX index is making new all-time highs driven by stocks like ASML, KLAC, AMAT, AMD, ARM, and NVDA.

This space is being driven by the rise of AI technology and the increased demand for semiconductors to fuel generative AI.

Sector 3: Cloud Stocks

Cloud stocks have been on a tear in recent weeks.

Since Powell first announced that the Fed was going to stop raising rates, CLOU has not had a red weekly candle. Announcing that rate cuts were coming added jet fuel and the sector has been on fire ever since.

Key names in this sector to keep an eye on are SNOW, CRWD, NET, WIX, ZS, and GDDY.

For more information on stocks to focus on, watch the video below:

Bless you for sharing your wisdom with us:)