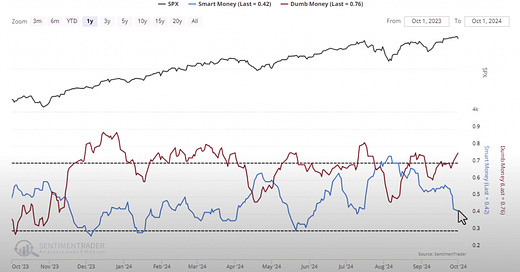

Smart Money / Dumb Money Confidence

It has been a while since we’ve reviewed the Smart Money / Dumb Money Confidence chart, or as we refer to it, Institutions vs. Retail Confidence.

Right now we are seeing something noteworthy so let’s dive into it:

As you can see, we have seen retail increase their exposure to the market over the last month while institutions have done the exact opposite.

While it may be concerning on first glance that institutions are reducing exposure, keep in mind that the market has been flat. We haven’t seen a significant sell off in the market as a result.

What that means is once institutions return to the market, we will have a driver that can push us higher. I actually see it as a relatively bullish sign that we have been able to base with declining institutional backing in the market.

Retail reaching a high level of exposure doesn’t necessarily concern me either - you can see that this doesn’t necessarily mark tops.

Finally, we see that the spread between institutions and retail is at one of its widest points in the last year. The last time we’ve seen a spread like this was December ‘23 and June ‘24 - both of which were followed by rallies.

For more detail on what I am seeing in the market, click here:

I've been speculating in options for 38 years and I've learned more from Tony in the last 3 days than I have reading dozens of investment books. The information from Arete is both relevant and practical. Something I can get my teeth into, so to speak.