Institutions vs. Retail

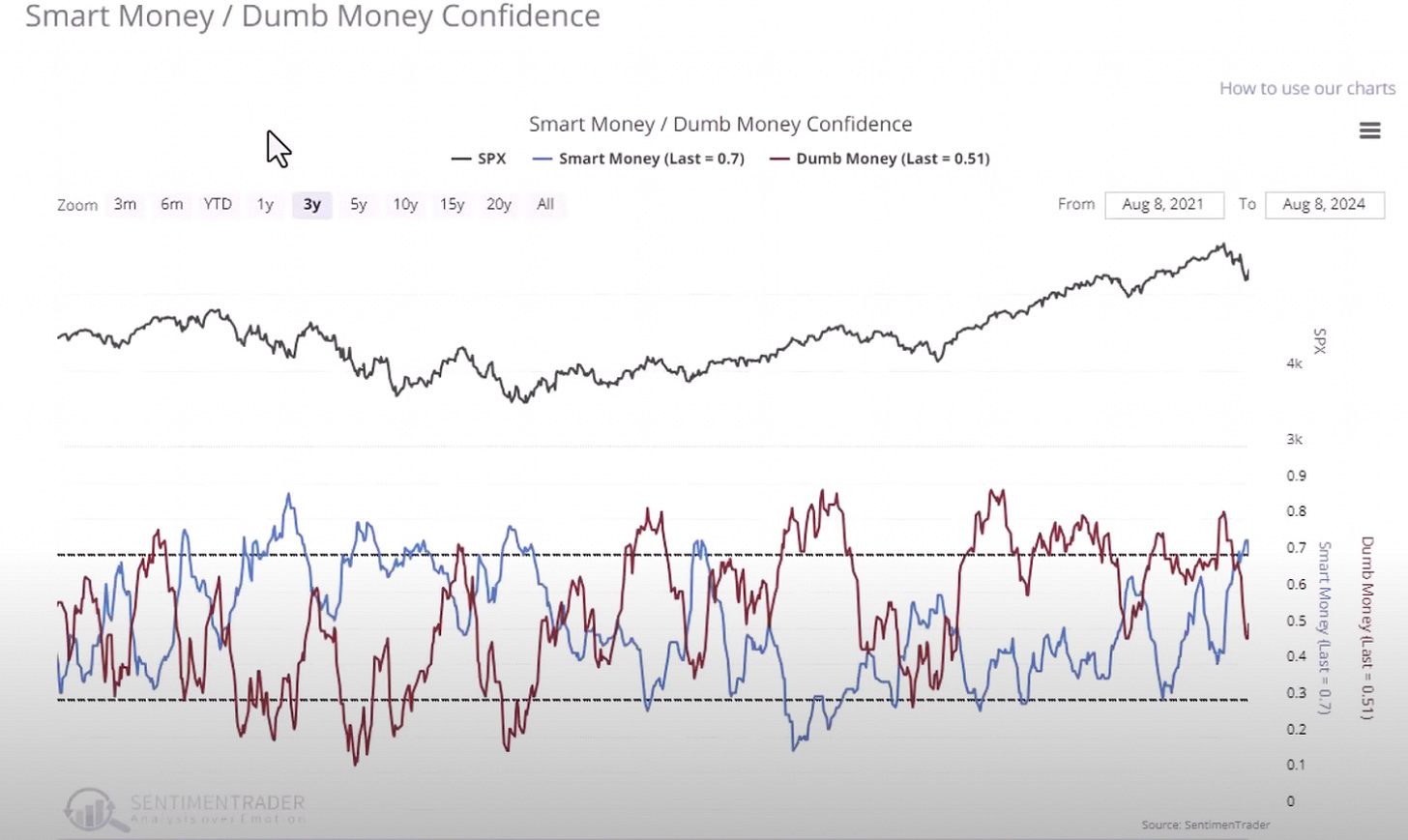

As always, I want to remind everyone that the chart below we don’t refer to as “smart money vs. dumb money” and instead “institutions vs. retail.”

What’s important to note is where institutions are right now. You can see that over the course of the major sell-off we saw recently, retail dumped their positions, however it is actually the exact opposite for institutions.

Not only are they remaining in their positions, they are increasing their increasing their investment into the market.

We know that institutional dollars make up the vast majority of money in the market. When you execute a trade, it is probably an institution on the other end.

So I think it’s really important to put this recent sell-off in the context of where the selling is coming from. Retail is much more nimble and able to unwind their positions quicker. It looks like that is all we saw recently, while institutions remained patient, watched it all unfold, and bought more.

More on what this means for the market here: