📈Solar Stocks Rally into Powell Speech!

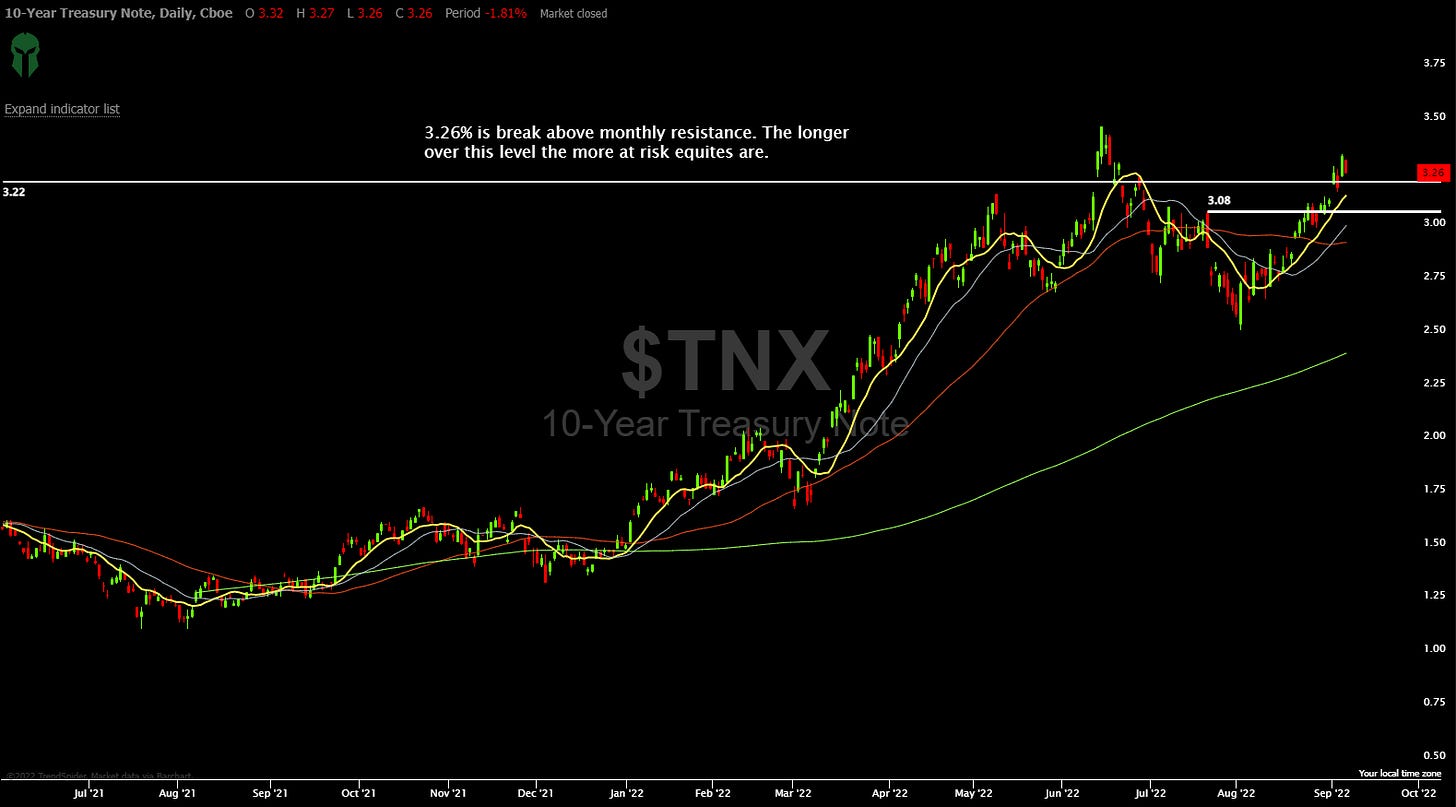

Solar stocks soared today with ENPH making new highs. The entire sector saw inflows today and held the highs of the day. This is the first time we have seen breakouts of a sector hold in over a month. The European energy margin call of $1.5 Trillion rattled the market and send crude oil down $5 dollars today. The issue with a margin call of this magnitude is we do not know the full scope yet. Yesterday it was announced that the energy firms were out of position when Russia shut down Nord stream 1 to Europe. This spike natural gas causing huge losses in the hedges of the energy firms. We are seeing the beginning of the unwinding. Issues of this size can take weeks to work their way through the system. This will add wild swings to commodity prices. Focus specifically on the crude oil market. The price of oil is tied directly to our GDP not only directly but indirectly. When oil prices drop consumers can buy more goods and companies pay less for transportation. Both of these affect corporate earnings in a positive way. It is possible that the drop in oil prices will actually help the underlying earnings of the SPY and help to support the Index. We saw this start today. Indexes rallied across the board as the price of oil dropped. While solar names acted very well , we saw other sectors start to show inflows of capital as well. Retail did very well. We saw some of the names such as TGT WMT BJ AMZN all have positive moves higher. Some of them significant. Obviously , we need more time to see if this is a one time occurrence but its worth noting. Tomorrow at 9:10 am Powell will speak. His last speech at Jackson hole sunk the market after he appeared hawkish. Surprisingly bonds actually rallied ahead of tomorrows meeting. We saw buying in treasuries , investment grade and high yield bonds. Usually, bond traders will wait but they seem to be anticipating a possible dovish stance. We will find out soon enough. In tonight’s video below. I go over several trade ideas, the huge move in the solar sector, the correlation of the SPY to crude oil as well as what to expect tomorrow. Considering these turbulent times its worth knowing what to expect. Let’s get to it!

Let’s Look at Our Indexes !

For now all stock ideas are in the video and are very short term oriented until the market starts to base. There are several great ideas in the videos but the time frame is much shorter. Video is a better format for being timely.

Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes Longs and Shorts. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube. The video below is the Top 5 from tonight and focused on the Crude Oil and SPY correlation over 2022. Pay close attention to what is said about how to trade solar names tomorrow!

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Preview the AT Trading Community

👇👇👇

✓Trade To Win! 🔥