Economic Data

Yesterday we received a lot of economic data and it has me concerned.

GDP came in in-line with expectations, albeit a very low expectation of 1.3% (compare that to the previous reading of 3.4%).

What most people didn’t pay attention to is the Corporate Profits data that showed a massive decrease.

It was supposed to come in at 3.9%. Instead we got -1.7%. That is massively recessionary.

Are We Seeing Stagflation?

Take this information on weak GDP and Corporate Profits and couple it with the PCE Prices data we received. The previous reading was 2% whereas we now came in at 3.6%.

So essentially what we are seeing is that GDP is dropping significantly, yet prices are remaining high. The GDP softness would be acceptable if we saw that prices were decreasing, signaling an end to inflation, but that is not what is happening.

This is extremely troublesome.

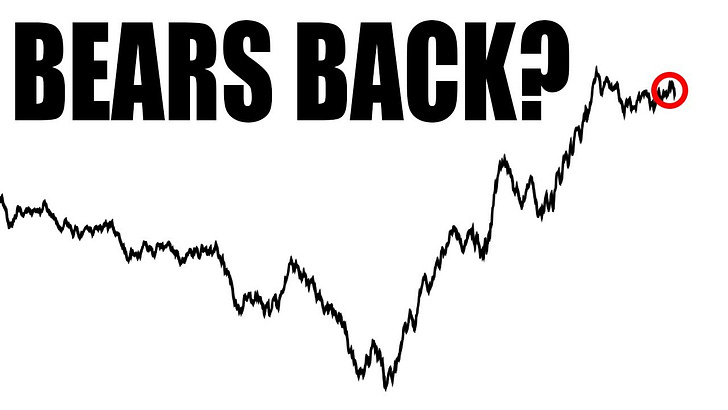

I share my outlook on the market in the wake of this news here: