📬 Weekly Market Outlook

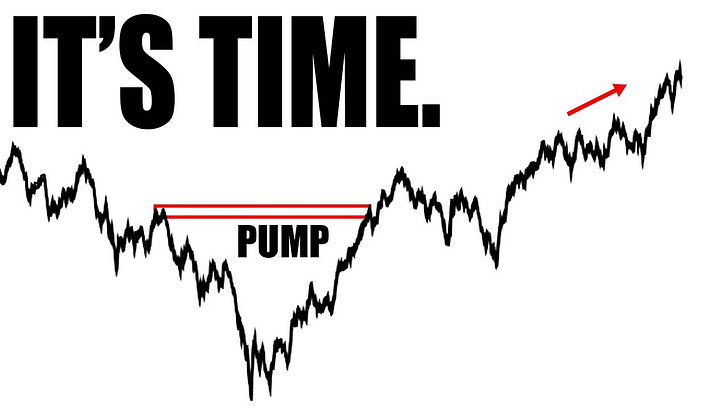

Stocks at highs as Non-Farm Payrolls loom.

I break down this week’s best setups, rotation themes, and 2 bonus trades not shared anywhere else.

Last week confirmed what’s working — and what’s breaking:

✅ AI demand is still red-hot — $SMCI soared post-earnings

❌ $TSLA rejected another breakout level

🟡 CPI + PPI this week = potential volatility spark

Here’s how we’re positioning going into the week:

📌 $TSLA – Rejected Hard at $360

Tesla tried to break out — and failed once again.

🔻 Rejected $360 on volume — third failed breakout attempt

🔻 Now trading below its 22-day SMA

⚠️ $317.33 is the must-hold level on the downside

📉 Action Plan: Avoid until it reclaims $360 with conviction. Breakdown risk is high below $317.

🏦 $AVGO – Bull Flag at All-Time Highs

Broadcom remains one of the strongest setups in the market.

🔹 Consolidating just under all-time highs

🔹 Forming a clean bull flag — not a base

🔹 AI infrastructure demand from $META and $NVDA fueling momentum

📈 Action Plan: Watching for a flag breakout continuation if CPI doesn’t shake the market. Sympathy flow in $SMCI and $MU likely.

💡 $AAPL – Rebuilding, But Still a Laggard

Apple is showing signs of life — but it’s still behind.

🔹 Bounced off $196 support

🔹 Needs to clear the 200D and push above $210 to matter

🔻 Still the weakest mega cap name on a relative basis

Unless buyers step in meaningfully, capital may continue flowing into better risk/reward AI plays.

🧠 Macro & Sector Themes

The real battle this week is macro vs momentum:

📊 Non Farm Payrolls (Thursday) will dictate rate cut odds into September

🚀 Semis and AI remain the strongest themes

💀 Mega caps ($TSLA, $AAPL, $AMZN) are showing structural cracks

💡 $SMCI breakout was the tell — AI infrastructure is where flows are going

We want to stay in what’s working and avoid dead money.

🎯 Bonus Setups in the Full Video

In this week’s breakdown, I go deeper into:

🔹 $TSLA’s rejection at $360 and why $317 is key

🔹 $AVGO’s bull flag + trade management

🔹 2 software names I’m watching that haven’t moved (yet)