📈STOCKS HIGHER! SOLID EARNINGS!

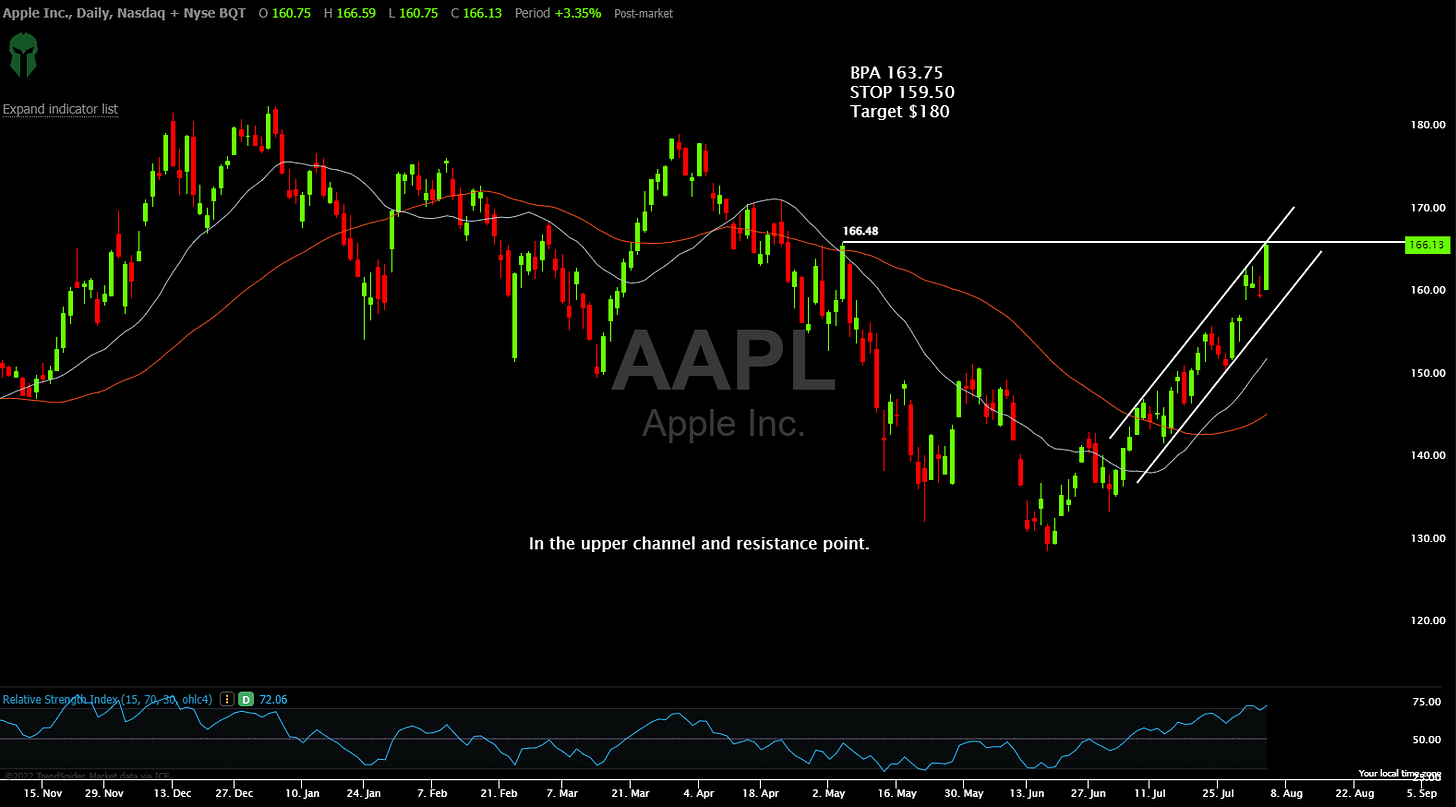

Indexes pushed higher on solid earnings from the past week and today. Apple and Amazon both had solid earnings reports and talked about how they see demand accelerating. It’s important to note that today both AAPL and AMZN broke above their highs from those earnings calls last week. This means we are seeing continued buying in the leaders. AMD issued guidance and earnings that was ok but not stellar the stock opened down but rebounded later in the day. The semiconductor index broke out above the upper channel for the first time since it was formed (see below). It is impressive that even bad earnings reports are seeing their stocks go higher. Usually this happens when expectations are completely washed out which seems to be the case. I am not suggesting we are heading into a breakaway bull market. What I am saying is that it is getting easier for us to have winning trades now. Breakouts are working. Dips are being bought. All of the indexes are currently above their average price from the march peak. This is bullish. Couple this with the indexes making higher highs and lower lows and we have a potential bottom. I think it is important to note that this recent rally is very different than the previous one in march. Technically speaking we have had 4 higher lower in this recent bounce which is very different. Essentially higher lows mark dip buying. We had zero higher lows on the daily indexes during march. That implies short covering versus real buying. For now we are getting overbought as noted in the RSI on the charts below but we can work that off. For now I continue to be a dip buyer. You will see several additions to the newsletter from the trading community below. We are focusing on buying stocks coming out of bases on pullbacks and its working. A letter went out earlier today letting newsletter members know that the trading room has open enrollment for the next 5 days and then enrollment will close for an undetermined period of time. Let’s get to it!

Let’s look at our Indexes

Let’s look at our Stocks

Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes Longs and Shorts. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube. The video below is the Top 5 from tonight and focused on several technical levels. Pay close attention to what is said about how to trade LCID, Lucid Motors and the Indexes.

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Preview the AT Trading Community

👇👇👇

✓Trade To Win! 🔥