Quadruple Witching is over and all our positions made it through not only unscathed but some actually rallied. As stated previously all four asset classes expire simultaneously and this can lead to wild swings The day played out fairly close to what we stated. Solid early volatility met by tighter and tighter positions. There was a lot of opportunity to add or start new positions.

Russell continues to be the leader. The index simply just keeps riding the high end of the channel trend.No reason this will change. $SPY looks muted and led with the worst volume of the three indexes. $QQQ Made news highs on a hammer bar and looks ready to run. I touched on this earlier. I expected more low end buying of beaten down sectors.Instead we are seeing massive runs in Software and tech. Also pockets of biotech moving. I attribute this to window dressing. Window dressing is when fund managers who are under performing on the year start new positions in hot names. While silly, it happens. With 76% of all funds managers under performing the $SPY the year, this move is getting exacerbated. Also we could see pressure on the beaten down sectors with locking in tax losses.

$ARKK is still hitting new highs. As mentioned $CRSP and $EDIT are building a bull flags. Notice how similar both charts are. Cathie Woods $PTON add was perfect with the stock making new highs.

Lets look at the Indexes!

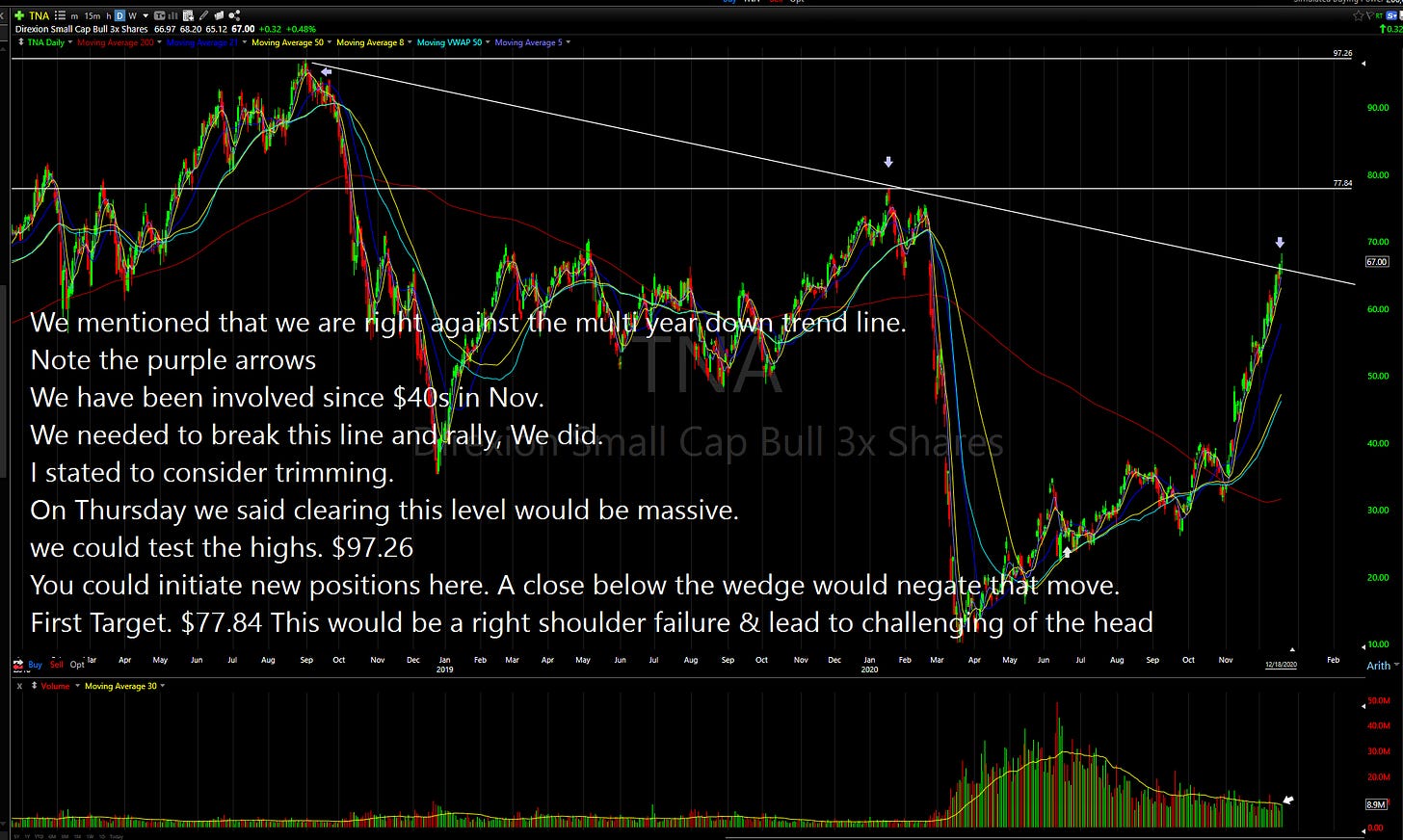

Lets look at the $TNA ETF Note the THREE purple arrows.

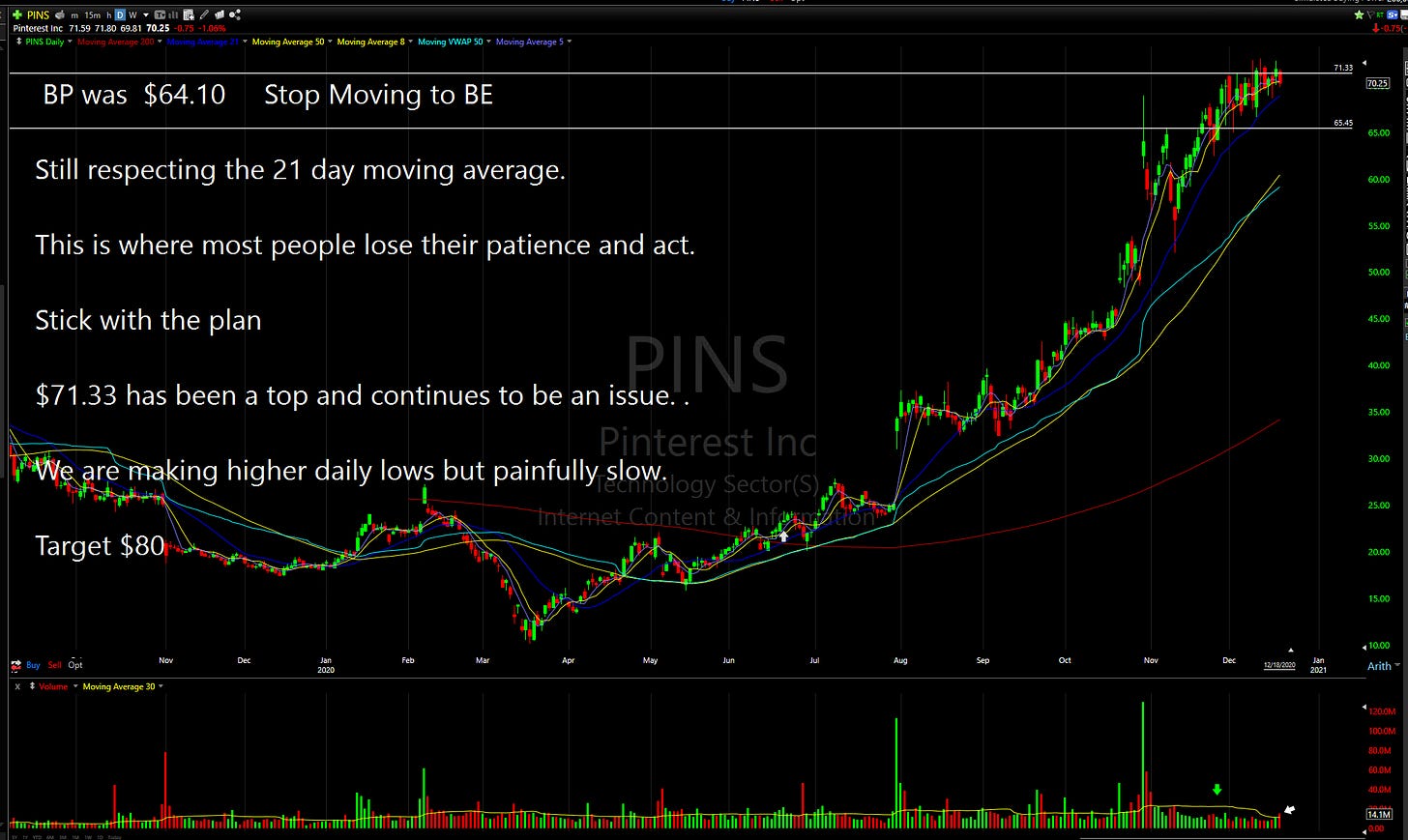

Lets look at our stock ideas !

As always all investment decisions need to be made by the individual. We all have different risk profiles and no two people trade or invest the same. Please make sure if you follow the Newsletter , you follow @aretetrading on Twitter. Also if you already follow me on Twitter consider turning on notifications. There are time my updates are timely in regard to what is in the Newsletter. If you do not see a position and have questions please ask me. Thank you again for all the messages telling me how this Newsletter helped your performance. I am truly humbled.

Lets finish strong!