The AI Platform Insight Most Investors Don't Understand Yet

People are missing the distinction between AI as operating system and AI as application.

Economic uncertainty may be at a 25-year high, but one trend remains exceptionally clear: the AI revolution is accelerating, not slowing. How can we cut through the noise of the market right now, and understand where the rollercoaster is headed?

Let’s break it down:

1. Blackwell is already a juggernaut for NVDA

Despite widespread speculation about potential AI investment slowdowns and DeepSeek shocking the industry into a capex retreat, NVDA's numbers tell a different story:

$11B in Blackwell revenue in Q4 FY25 – "the fastest product ramp in our company's history"

Data center revenues are up 93% YoY and 16% QoQ to $35.6B, very much the opposite of losing momentum

Gross margins only temporarily in "low seventies" during rollout, and expected to hit "mid-seventies later this year" as production scales

NVDA CFO Colette Kress is not worried about slowing capex or getting DeekSeeked:

"Customers are racing to scale infrastructure...With Blackwell, it will be common for these clusters to start with 100,000 GPUs or more. Shipments have already started for multiple infrastructures of this size."

Jensen is not worried about the market losing appetite for AI advances:

"We're really three years into that journey and in modernizing computers that have taken decades to build out. I'm fairly sure that we're at the beginning of this new era."

In fact, he seems to think there might still be (just a little) more market opportunity out there:

"No technology has ever had the opportunity to address a larger part of the world's GDP than AI. No software tool ever has. And so, this is now a software tool that can address a much larger part of the world's GDP more than any time in history."

Takeaway: We're still very early. Blackwell is a bellwether telling us that there is massive unclaimed space for AI infrastructure to grow into.

2. Cloud giants are doubling down

MSFT confirmed its $80B infrastructure investment plans remain on track to "meet customer demand."

Equally loud and clear, AMZN CEO Adam Jassy said on CNBC:

"We have a lot of demand for AI right now and a lot of demand for our instances that have Trainium chips, have Nvidia chips, AMD chips...at this stage...if we had more capacity than we already have -- and we have a lot --...we could monetize it."

These aren't companies pumping the brakes.

In parallel, the meta-revolution accelerates: AI is now designing chips that outperform human-engineered ones, with layouts so unconventional that human engineers struggle to comprehend them. AI improving its own infrastructure – this feedback loop matters. It will not slow down.

Takeaway: The cloud giants aren't just spending billions for show. They're building the infrastructure for an AI-first world while most investors are still debating if what was rolled out last year is even here to stay.

3. People see AI operating systems now, but not the AI applications that are coming

Which brings us to what many investors are missing: we're still debating the merits of groundwork AI when the real value accelerators have barely started to take shape.

Apple Intelligence, Alexa, and similar technologies aren't themselves applications—they're operating system-level frameworks that will be able to support many kinds of applications. But the average consumer or investor sees the AI skeletons we have now as the intended final result.

When Huang says, "No technology has ever had the opportunity to address a larger part of the world's GDP than AI," he's not talking about chatbots. He's talking about the tsunami of industry-specific applications that will be built on these AI operating systems—the next wave that will dwarf what we've seen so far.

Takeaway: If you think AI usefulness has plateaued, you're confusing the foundation for the skyscraper. And infrastructure tools like Blackwell from NVDA are the construction crew that just arrived.

What I’m reading

📚 Outlive: The Science and Art of Longevity by Dr. Peter Attia is a great book I am digging into on how to think about medicine and quality of life. It’s a #1 New York Times bestseller, The Economist and Bloomberg’s best book of 2023, and called “A groundbreaking manifesto on living better and longer that challenges the conventional medical thinking on aging and reveals a new approach to preventing chronic disease and extending long-term health.”

Here’s a passage I’m thinking about:

Evolution is no longer our friend, because our environment has changed much faster than our genome ever could. Evolution wants us to get fat when nutrients are abundant: the more energy we could store, in our ancestral past, the greater our chances of survival and successful reproduction. We needed to be able to endure periods of time without much food, and natural selection obliged, endowing us with genes that helped us conserve and store energy in the form of fat. That enabled our distant ancestors to survive periods of famine, cold climates, and physiologic stressors such as illness and pregnancy. But these genes have proved less advantageous in our present environment, where many people in the developed world have access to almost unlimited calories.

More noteworthy signals & developments

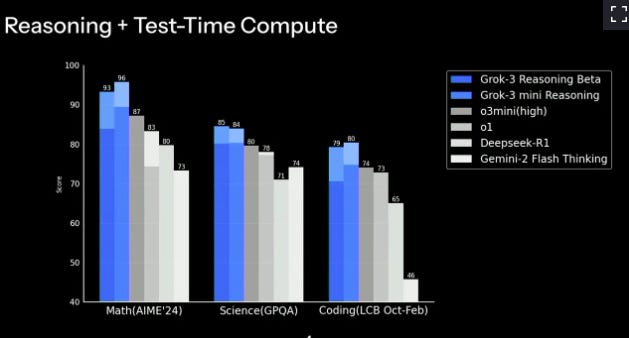

⚡ The AI race continues with Grok 3 now claiming they are faster at reasoning then Deepseek R1. I would expect the title of “best” to go back and forth for a while - eventually we’ll get a winner, but we are far from that being decided.

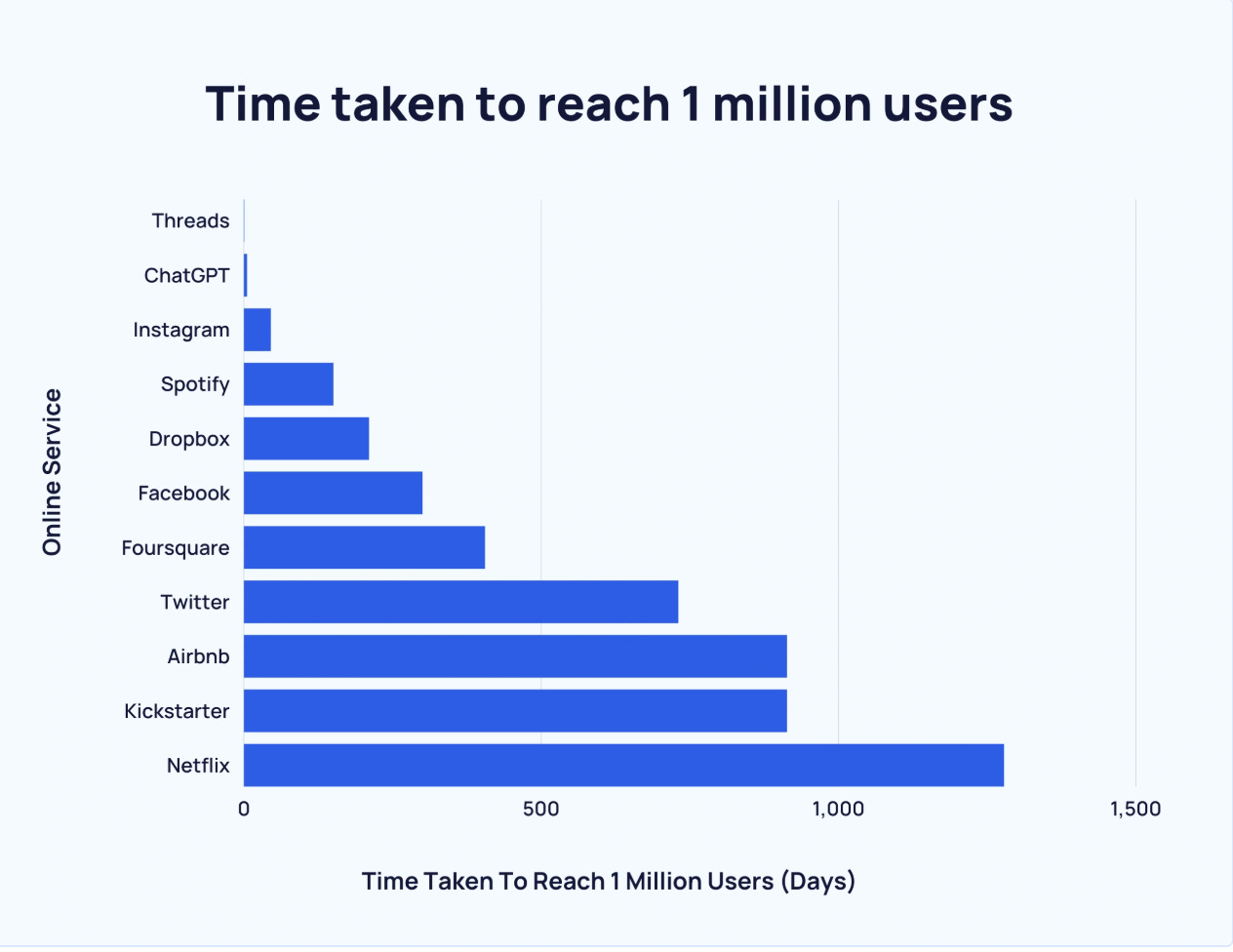

📈 The only app to reach 1 million users faster then ChatGPT is Threads. This might shed light on why META have stated plans to release a META AI app.

👝 Hermès now holds ~50% of its balance sheet in cash. When luxury brands get this defensive, it's a warning sign about high-end consumer spending.

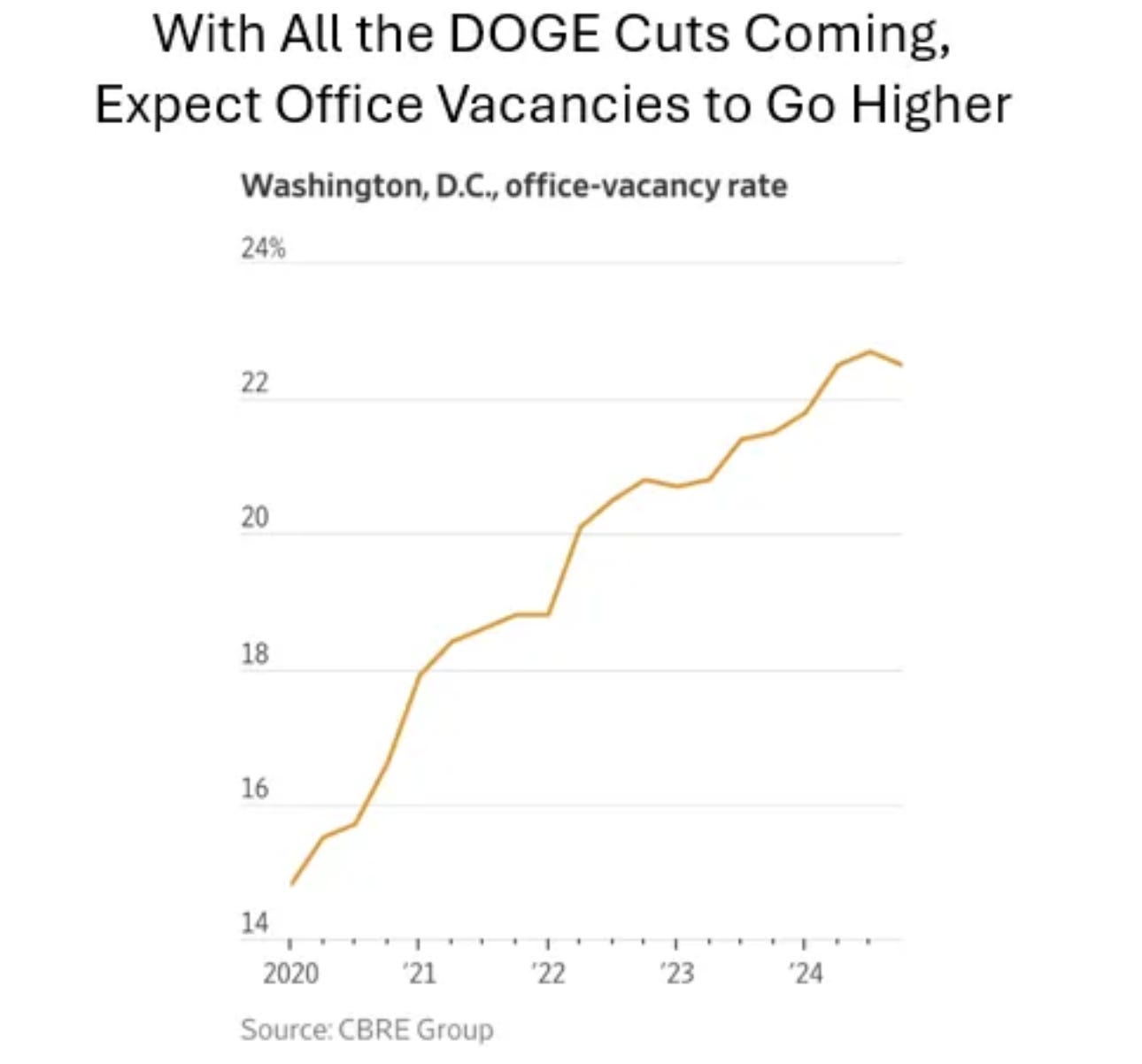

🏢 DC office space is exploring a new career as a ghost town. As cuts continue, this restructuring will create both casualties and opportunities.

💼 DOGE slashing government jobs is already visible in the data. DC datasets tell a clear story that the landscape is materially changing, with ripple effects that are just getting started.

💸 Institutional money wants more crypto and China exposure. Cantor Fitzgerald (led by Commerce Secretary Howard Lutnick) is significantly ramping Bitcoin exposure via ETFs while adding positions in MSTR and MARA, as well as Chinese tech giants BABA, BIDU, and JD to their portfolio.

The bottom line

When uncertainty reaches multi-decade highs, focus on companies executing effectively on a clear vision. AI infrastructure buildout continues unabated. The fundamentals tell the real story of who has edge – these are the leads we can follow.

We're not just witnessing technological change or evolution in steps. We're seeing technology reshape global capital allocation at unprecedented speed.

👉 What idea was your favorite? What do you want to see more or less of each week? Tell me here.

This week’s video

Thanks for that. Very organized and helpful.

Excellent article, I printed it out and will high light the heck out it.