📈 The Biggest Trade of the Year..

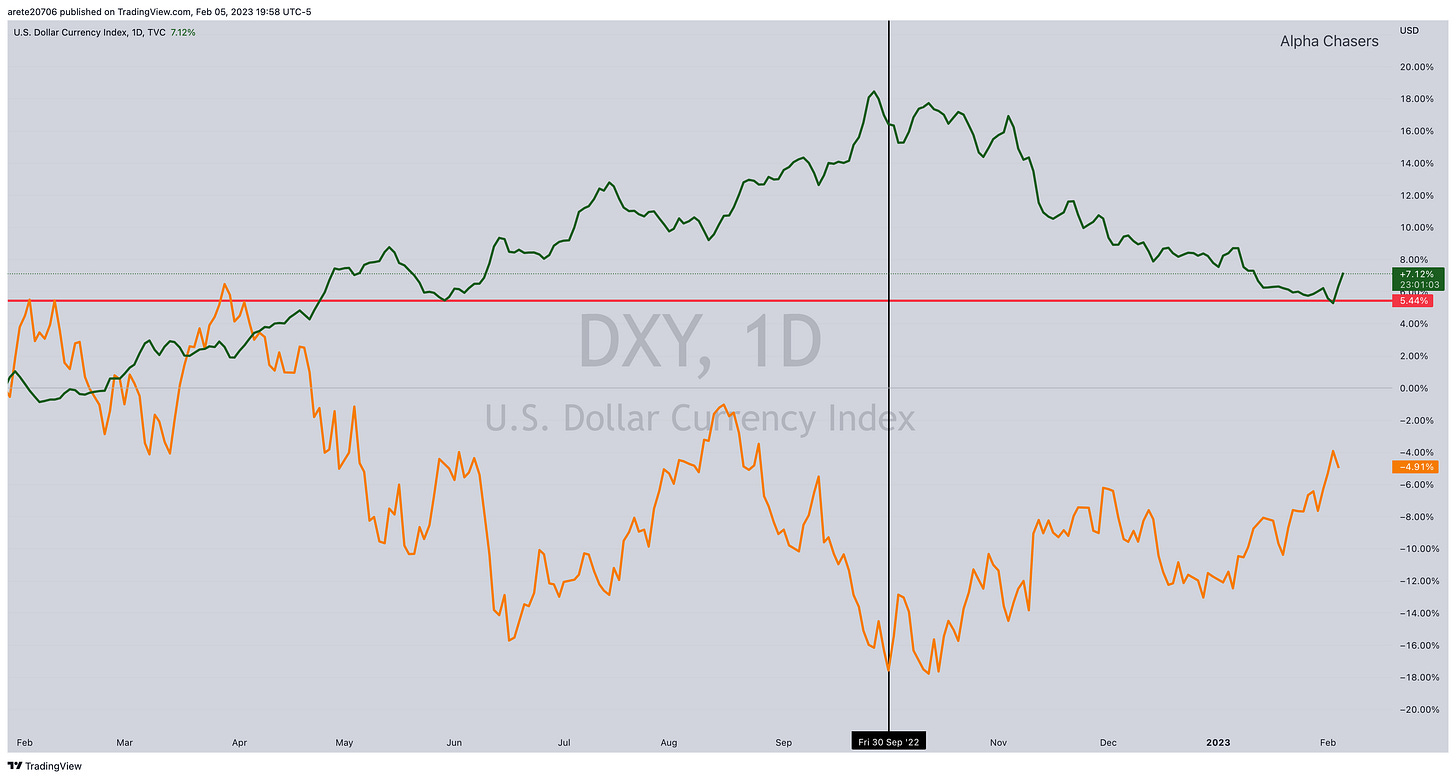

The biggest trade of the year is the trade being placed by Macro strategy investors. Over the course of the last three months large institutional funds have plowed money into a short U.S. dollar and long the emerging markets. The trade benefits from a weak dollar and emerging markets rising prices. If we think of it this way when the dollar is weaker other countries can buy more goods and services with less of their local currency. No different than when the U.S. dollar was rallying in 2022 increasing its citizens buying power. If we look at the graph below we see from Sept 30 2022 to date denoted by the black vertical line. The dollar(green) peaked around the same time emerging markets(symbol EEM) bottomed. This is not a coincidence.

If we zoom in to a time frame of September 20th to date. We can see the dollar(green) is down -8.18% while the emerging markets(blue) are up 16.92%

While this trade can continue to be lucrative it is a cautionary tale if the trade becomes to crowed. For example. The dollar is currently holding a major support level at 102.60. Should this persist to rally it not only affects the large macro trade but U.S. equity markets as well.

If we look at the SP500(orange) we can clearly see the bottom took place at the same time the U.S. Dollar topped. Should the dollar rally that could set the indexes up for a pullback or correction.

To know what stocks are on my watch list this week click the link below.

Alpha Chasers Community Waitlist Click Here

1 on 1 Coaching Program Click Here

Wishing Everyone Massive Success in 2023 🍾