CPI Release

CPI data released today and data came in strong, showing a month-over-month decline. This is exactly what we were looking for.

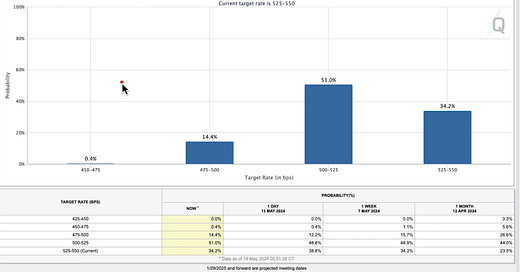

We saw significant movement in probabilities for rate cuts. Looking below, you can see that we have a 65% chance of a rate cut in September, which was not previously the case.

We are even seeing an increased chance of a cut in July, sitting now at 33%. This means that fears of not seeing rate cuts this year/potentially raising rates are dissipating.

Stock Market Shift

As a result of the CPI data, traders are going to move from focusing on the macroeconomic conditions to fundamentals. I often talk about the stool in my videos- and now that we have inflation/rate cut concerns in the rearview mirror, fundamentals will be the next focus area for institutions.

Going forward you will need to understand company financials, performance, and catalysts to find the best stocks to enter.

One very important shift that I am noticing is that the Nasdaq is setting up to outperform the S&P 500. This is a key sign of a bull market. Whenever the market rises, tech leads.

By looking at QQQ / SPY, you can see just that - we are breaking out of a flag with the Nasdaq outperforming.

Watch this video for an in-depth review of how the market is shifting and how to take advantage of it: