What is the NAAIM Number?

The NAAIM stands for the National Association of Active Investment Managers.

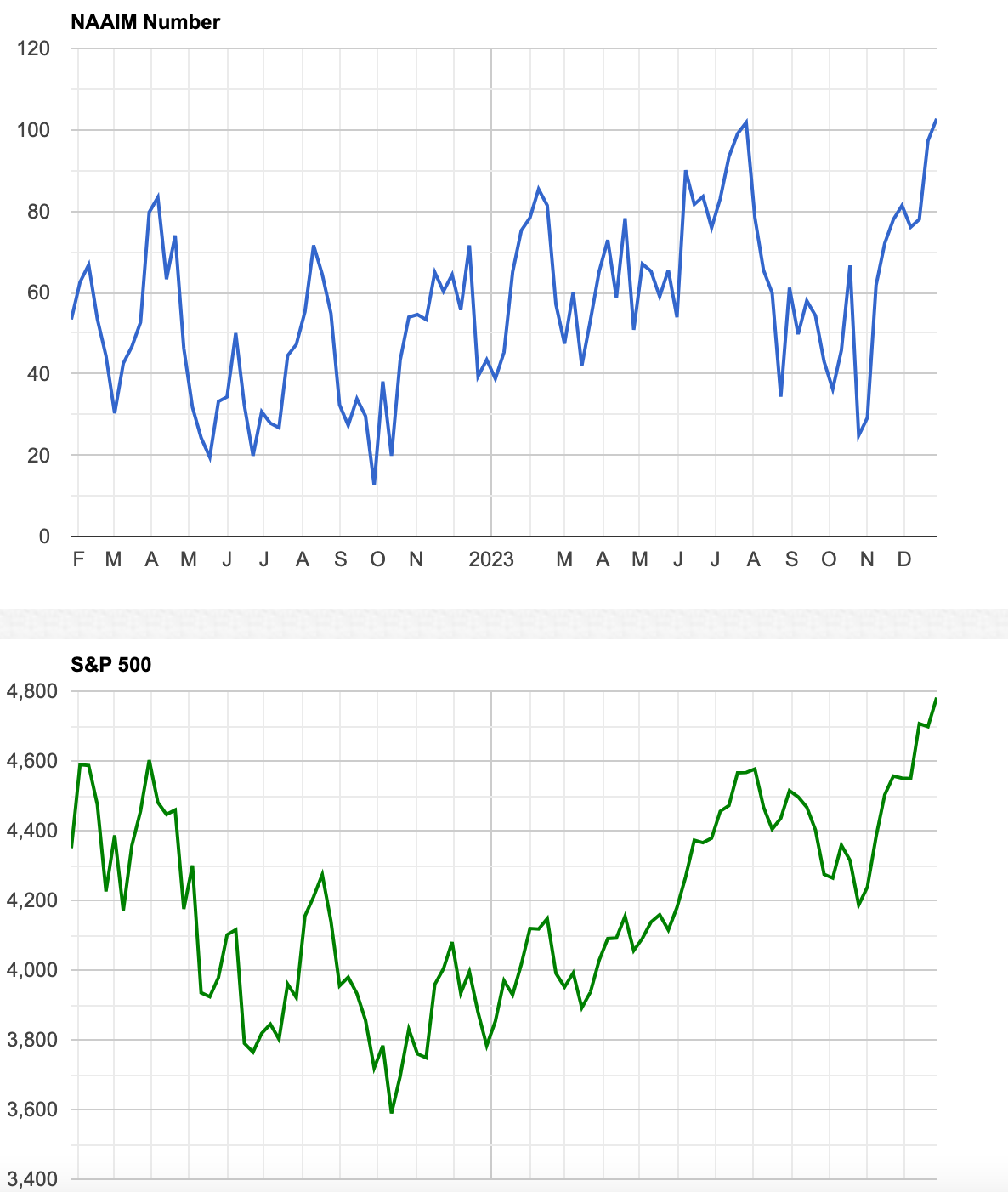

They provide an NAAIM Exposure Index (the NAAIM Number) which gives an indication as to how investment managers have adjusted client accounts.

While the NAAIM number has been correlated with how the stock market moves, we cannot say that it is causal. I will explain why we must not assume the NAAIM Number causes the stock market to move.

Analyzing NAAIM Data

The image below shows an arrow every time the NAAIM Number has peaked over the past few years.

Looking at the last two peaks (not including the most recent one), we can see that asset managers began reducing exposure for their clients just before drops in the stock market.So does this mean that the current NAAIM Number peak will lead to the same? Not necessarily.

This is where we need to lean on our understanding of macroeconomics.

Putting the NAAIM Number In Context

First, there were many times in 2020 that the NAAIM Number peaked, yet the market continued to rise. Why would that be?

We know that during this time there was $1.7T dumped into the market.

Then what caused the NAAIM Number to accurately predict a top in the stock market in November 2021?

It didn’t predict it - Jerome Powell announced that the Fed was shifting its policy to stop injecting money into the market.

What about when it accurately called a top in July 2023?

This was when Japan changed their monetary policy and signaled they may begin raising interest rates.

Putting it All Together

The point that I’m making here is that we should not rely on the NAAIM Number to tell us what is going to transpire in the stock market.

Therefore, just because the NAAIM Number is peaking right now, does not mean that we have reached a top and the market is going to sell off.

An understanding of macroeconomics will get you much closer to being able to call tops and bottoms (though nobody will ever be perfect).

For more information on the NAAIM Number and how to use it, watch this 10 minute clip below: