Bitcoin ($BTCUSDT) struggling with the 67K level. MACD bearish weekly cross.

Coinbase ($COIN) struggling after CME stated they would be getting into Bitcoin.

Russell 2000 ($IWM) continues to struggle with 2022 levels.

Regional Banking ETF ($KRE) forming a bullish pendant.

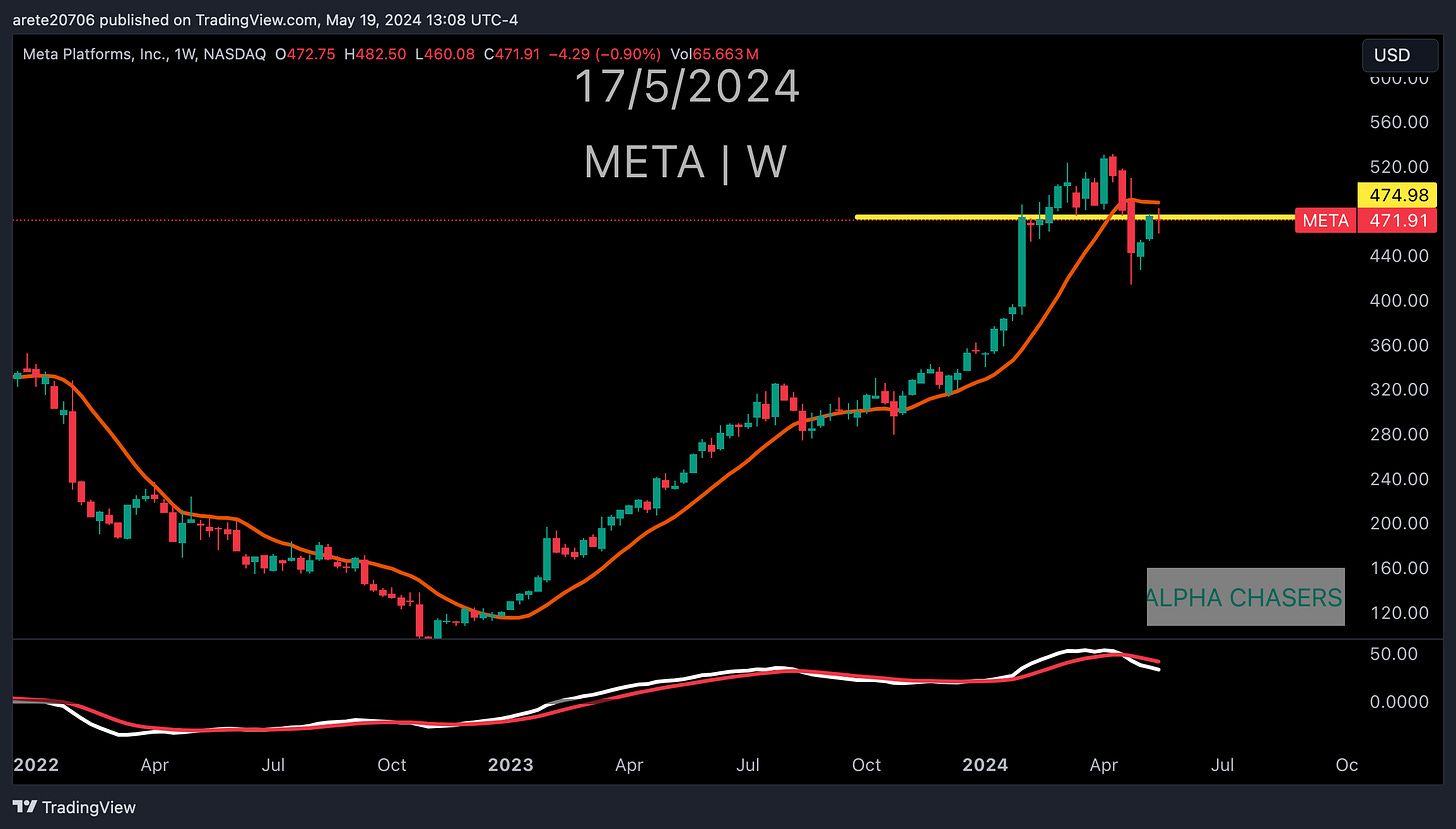

Meta Platforms ($META) having issue with the $475 level.

Microstrategy ($MSTR) with a massive reversal on the week.

Nvidia ($NVDA) earnings will be watched closely this week.

Nasdaq ($QQQ) with an all time closing high.

Semiconductors ETF ($SOXX) is lagging the Nasdaq but NVDA earnings this week

S&P 500 ($SPY) an all time closing high.

10-Year Treasury ($TNX) has broken below 4.5%

Supermicro Computers ($SMCI) with a 5 seek closing high

Financials ETF ($XLF) with an all time closing high.

Costco ($COST) all time closing high. WMT had great earnings and BJ earnings are this week.

Copper supply is falling - bullish for copper long term.

Percent expecting a stronger global economy vs. S&P 500. This usually leads to them trading much closer together.

AI mentions on earnings calls seem to be all the rage now.

ISM Services PMI Dropping which is causing inflation to drop.

New delinquent balances are rising on credit cards. worth watching.

Watch this weekend’s video for stocks I am looking to trade this week: