S&P 500 ($SPY) All time highs and broadening out

Nasdaq ($QQQ) solid reversal after lower low into an all time high

Russell 2000 ($IWM) breaking out multi year base.

Ten-Year Treasury ($TNX) back under 4.25%

Bitcoin ($BTCUSDT) approaching all time highs.

Semiconductors ETF ($SOXX) continues to see inflows

Industrials ETF ($XLI) breaking away from its correlation to the dollar

Consumer Discretionary ETF ($XLY) A new multi year high

Technology ETF ($XLK) all time highs despite AAPL and MSFT lagging

Nvidia ($Nvidia) massive buying continues.

Super Micro Computers ($SMCI) added to the SP500 Friday after the bell.

Dell Computers (DELL) record earnings and revenue.

Broadcom ($AVGO) earnings this week.

Viking Therapeutics ($VKTX) phase 2 study went exceptionally well.

Hong Kong Property Developers’ Share PricesSemiconductors ETF look to have bottomed.

Share of Cities with Positive Rent Growth is Rising

More Companies are Looking to Raise Prices

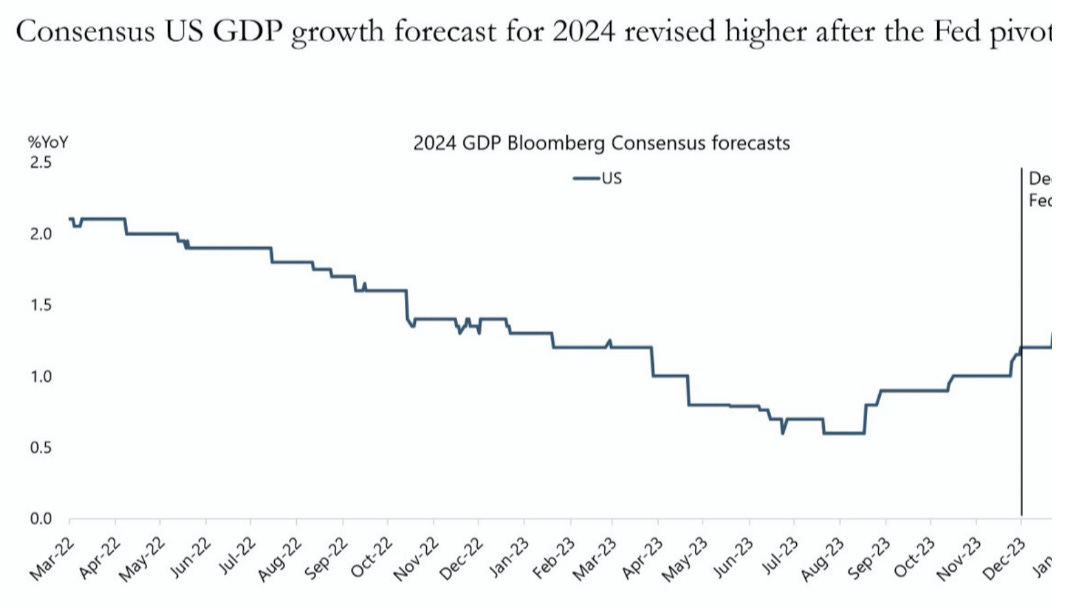

Consensus US GDP Growth Forecast for 2024 Revised Higher After the Fed Pivot

Flows into Cyclical vs Defensive Equity Funds

Watch this weekend’s video for a breakdown of the most active names and a game plan for next week. Pay close attention to the SMCI comments.

We need find another $SMCI Pronto