📈These Bank Stocks Are Rallying...

Several bank stocks are rallying massively while others are faltering. Regional banks are the most at risk of capital raises and runs on the bank. Larger banks and pension funds are at risk of having exposure to the wrong bank or the wrong debt instrument. For example this past week UBS merged with Credit Suisse. During that merger $17 billion dollars of debt was wiped out.

“Holders of Credit Suisse Group AG bonds suffered a historic loss when a takeover by UBS Group AG wiped out about 16 billion Swiss francs ($17.3 billion) worth of risky notes.

The deal will trigger a “complete write-down” of the bank’s additional tier 1 bonds in order to increase core capital” - per Fortune Magazine

During times of uncertainty we see fear. In that fear there is miscalculation of pricing due to panic with leads to clouded judgement. For example PACW issued a statement this week:

”PacWest highlighted its liquidity position, headlined by more than $10.8 billion in cash late Friday as part of an investor update. The bank noted that available cash exceeds total uninsured deposits.

PacWest experienced elevated net deposit outflows, but those outflows have since "fallen sharply" and deposit fluctuations have stabilized, the bank said in the update. As of March 16, insured deposits represented more than 62% of total deposits. Venture deposits represented approximately 25% of total deposits.

After a challenging week, we are encouraged that much of the volatility seems to have calmed over the past several days. We have taken numerous steps, including leveraging available collateral, over the past week to enhance and fortify our liquidity during this time," - Paul Taylor, president and CEO of PacWest Bancorp.

PACW rallied on the news but not even regaining half of what it lost.

Most interesting was the company stating it can pay off all its current losses and still function properly which means barring something unforeseen they can pay their obligations. This led us to put out an alert on the PACWP preferred stock paying 7.75% which at the time we purchased was trading with a 17% yield due to the fear and panic. Usually preferred stock trades around its issued price. In this case $25 dollars. Due to all the uncertainty and fear we are still trading at a massive discount even though the company issued a statement outlining all of their assets and ability to pay all the debt.

There is an old saying focus on what they do not what they say. This holds true when watching insiders of companies. While SIVB was at the Morgan Stanley Technology company touting its stock literally 48 hours before its collapse insiders were selling. See below how all the C level executives were dumping stock.

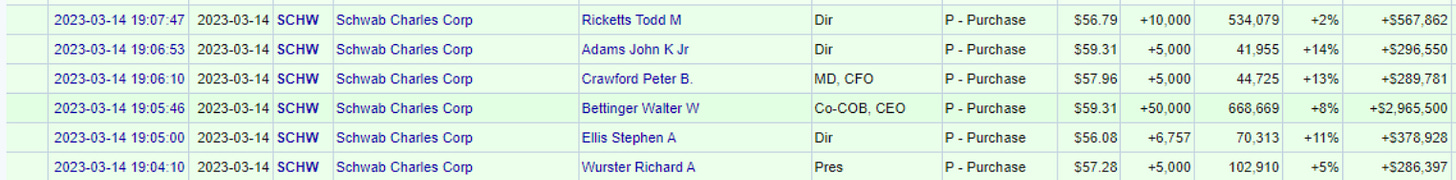

The goal is to find the exact opposite. Schwab ($SCHW) insiders continue to buy stock in the open market and the Founder and Chairman personally issued a statement and signed off on the letter explaining their financial health which at the time is robust. Its rare for a founder and chairman to do that but it shows how much he believes in the company. Focus on what they do. See below how directors and C level executives bought stock in the open market. This is only a partial list of their buys.

This and several other factors led us to put out an alert on SCHW at $54.75

There is massive opportunity in fear. It starts by watching the actions of the executives and then drilling down to find the diamonds amongst the coal. There are several other bank set ups that have not triggered and I will cover in future newsletters. For what to expect from the Fed , What large institutions are buying and what are the top banks I am looking to buy next watch the video below. Remember to share the newsletter if you find value in it. I purposely do not charge for it or run ads here or on YouTube. All the growth is organic.

Wishing Everyone Massive Success in 2023 🍾