📈These Three Stocks Are Leading but....

The Semiconductor sector rallied to a 30 day high but it was not NVDA and AMD that led the rally. The semiconductor equipment manufacturers led the rally and specifically the big three. The big three semiconductor equipment manufacturers are LRCX AMAT and KLAC. There are others but when it comes companies that are most necessary at the beginning of a cycle I will watch those three. I have used those three as a barometer for years and it has worked well in the past. Out of 197 industries semiconductor equipment manufacturers was the second strongest on Monday.

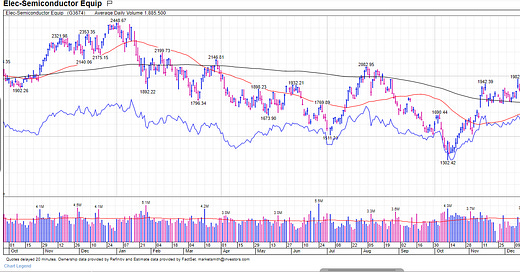

We can see the the breakout of the industry after massive consolidation.

The Semiconductor Sector itself (SOXX) has been coiling for a month and holding $400 as major support.

SOXL is the 3x ETF which we purchased last week in the Alpha chasers community. The upper end of the range is $18.30. This puts us inline with the SOXX at $440.

KLAC rallied a couple weeks ago on solid earnings but fizzled ahead of the economic data and fed meeting. We look ready to challenge $405 again.

LRCX had excellent earnings and broke through a multiyear base closing at a new 52 week high.

AMAT rallied and has earnings this week on Thursday. Investors will pay close attention to the backlog on the conference call. They will want to see if demand is picking up. The resistance level for the past two years has been $123.50 range.

For a more in depth look at the huge moves in tech names yesterday such as TSLA OHM and AI watch the video below.

Wishing Everyone Massive Success!