This Week in Sentiment: Going Lower?

Consumer expectations are at rock bottom, yet markets find support. The contradiction matters.

Sentiment indicators have hit extreme territory, and we have some interesting signals to get into for the key themes on watch.

Let’s start this week with a special look at where sentiment stands:

🔎 Sentiment snapshot, March 2025

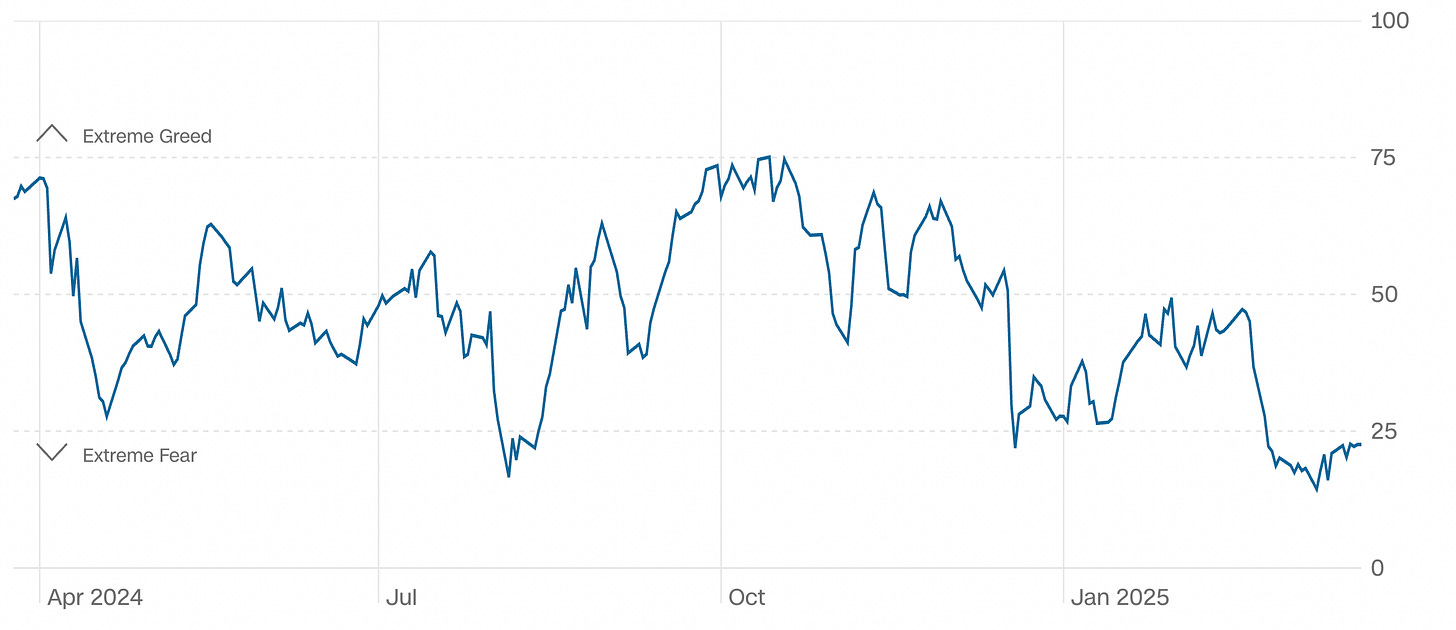

The Fear and Greed Index touched a low of 17, signaling extreme fear, and is starting to climb back. It’s interesting to note that April 18th and August 5th were also in the lows 20s. Now look at how that played out on the S&P500 chart.

Consumer expectations dropped below 2007-2009 GFC levels. That is majorly low and usually correlates to a black swan event of some sort.

In a recent talk at the Credit Opportunities Symposium at New York University, Marc Lansry (who manages distressed debt and has a different perspective then most equity investors) said:

An economy can’t survive like that. It just slows everything, and could push this economy into a recession.

Yet markets keep finding support at key technical levels. The S&P500 is exhibiting similar patterns to the October 2022 and 2023 lows. While the outcome is by no means certain, it’s worth examining closely where viable entry points can be. I get into this in much more detail in my video on Saturday.

So are we going to have a correction, a bear market, or neither? Ed Yardeni poses a few scenarios. I have been reading Ed’s research for the past 25 years and find his long-term views and research to be unmatched.

With that in mind, here’s what else you should get on your radar:

1. Tencent's 90% profit surge shows AI's real earnings impact

Tencent just reported a 90% profit surge with AI specifically highlighted as driving both revenue growth and cost reduction. This isn't speculative future potential but current earnings reality.

While many companies continue discussing AI's future promise, Tencent's results demonstrate that the ability to deliver immediate financial impact at scale is already here and spreading. KWEB's recent outperformance against QQQ suggests the market is looking to distinguish between companies with AI plans and those with AI profits.

Takeaway: The AI narrative is evolving from investment phase to earnings phase. Companies showing measurable results today deserve a valuation premium over those still in the spending cycle - for now.

2. Buy now, pay later arrives for groceries and staples, troublingly

Klarna is partnering with Walmart and DoorDash to let consumers finance everyday purchases from toothpaste to takeout. Nothing says "robust and healthy economy" quite like paying for your burritos in four easy installments.

Maybe this is a new normal thing. Or maybe when essentials move into the "needs financing" category, it signals deeper economic strain than headline numbers fully convey.

Takeaway: Financing instruments popping up in everyday consumer purchases is probably a warning sign to watch for trend sustainability. On a tactical level, some are viewing it as a negative for AFRM in the space.

3. Tesla finds support after Musk "reads the room"

Tesla shares have halved since their peak, with the political firestorm around DOGE creating significant headwinds. But Musk's all-hands meeting Thursday received fresh analyst praise, with Wedbush's Dan Ives calling it "a key moment for Musk and Tesla to show leadership, [which] he did."

In parallel, the stock has reached levels that historically have provided strong support followed by a bounce. For no reason in particular, I am reminded of a very famous Buffet quote:

Be fearful when others are greedy and greedy when others are fearful.

Takeaway: Tesla approaching key support with signs of leadership adjustment creates an interesting risk/reward setup for either side of the trade. Inflection points like these often signal a big bounce or a big break.

More noteworthy signals & developments

🍔 Americans consume more ultra-processed foods than any other nation, with 58% of the average diet consisting of these products. Surprisingly, Italy made the list, tied at #10. Companies positioned for the public health theme here deserve attention, as the obesity crisis represents one of the largest addressable markets in healthcare.

🛡️ Germany's defense spending may reach 3.5% of GDP—a dramatic increase from the historical ~1% level. Financial orthodoxy that defined German policy since WWII has been left in the dust practically overnight, which is worth watching develop.

🍷 Trump has threatened 200% tariffs on European wine imports, but California winemakers are expressing unease rather than excitement. They understand that retaliatory tariffs would likely target American products in return. The market often hesitates to price in second-order effects of policy changes until they materialize in earnings statements.

The bottom line

When fear readings hit extremes, the contrarian playbook typically suggests leaning against the crowd. Yet we cannot be too cavalier in dismissing structural concerns about consumer stress and recession warnings.

The sustainable edge we can hunt comes from determining which assets have priced in too much fear and which haven't priced in enough. When Buffett gave his famous advice about greed versus fear he wasn't suggesting blind contrarianism. Rather, he was advocating for rational analysis when emotions dominate markets.

The four most dangerous words in investing might be "this time is different." But the five most profitable might be "this time is slightly different."

Learned something from this issue? Pass it along to a friend.

I like this type of email.