Market Outlook

Let’s review some market internals to see where we’re sitting. We’ve had a hectic few weeks with strong buying followed by strong selling.

This will be a pivotal week for the market, especially with NVDA releasing earnings on Wednesday.

Stocks Above Moving Averages

Let’s look at the percent of stocks above key moving averages:

There are a few key things to be aware of here. First, on the stocks above the 5-day moving average chart, you can see that we’re getting pretty close to a support level. We’re currently at 27%, so it’s possible we see a bounce here soon. We just don’t know how soon.

The other charts tell us that the market is in a healthy place right now. We’re not seeing extreme reads on either side, which is a good thing.

However we will need to see how the next few days play out to determine whether we are going to resume our move to the upside or we still need time to rest.

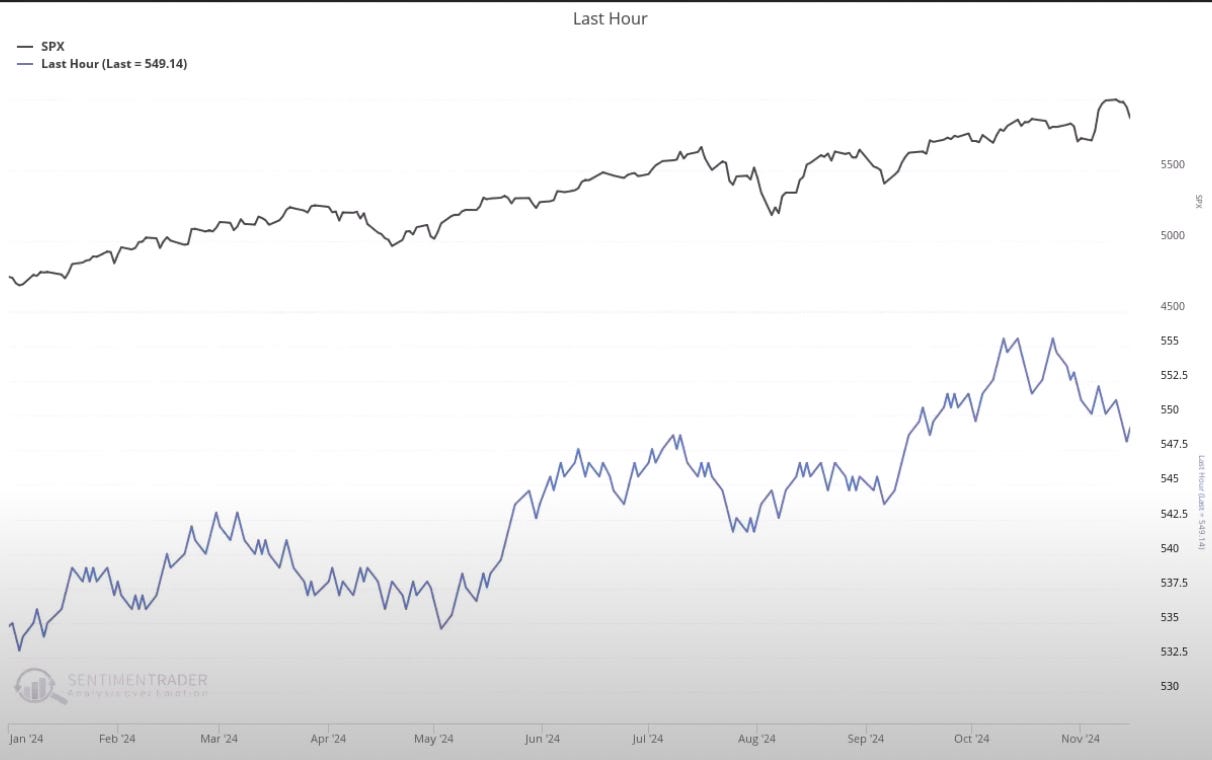

Last Hour of Trading

Looking at the performance of the market in the last hour of trading and whether we have net buyers or net sellers is very important.

Institutions do a large percentage of their trades in the last hour of trading, so this gives us a glimpse into what they are doing.

You see that we peaked in October but have seen a reversal in trend for the past few weeks, turning the last hour into net selling overall.

This isn’t a warning sign yet, but the change in trend is something to be mindful of and keep an eye on.

We always want to know what institutions are doing with their positions so we can trade on the same side as them.

I analyze this further and have some specific trade ideas in the video below: