Corrections Lead to Opportunity

While corrections in the market may be painful, they lead to fantastic opportunities to buy stocks at a discount, especially if you are looking out longer term.

Over the last ten years, we haven’t had any significant drawdown that wasn’t simply an opportunity to scale into stocks.

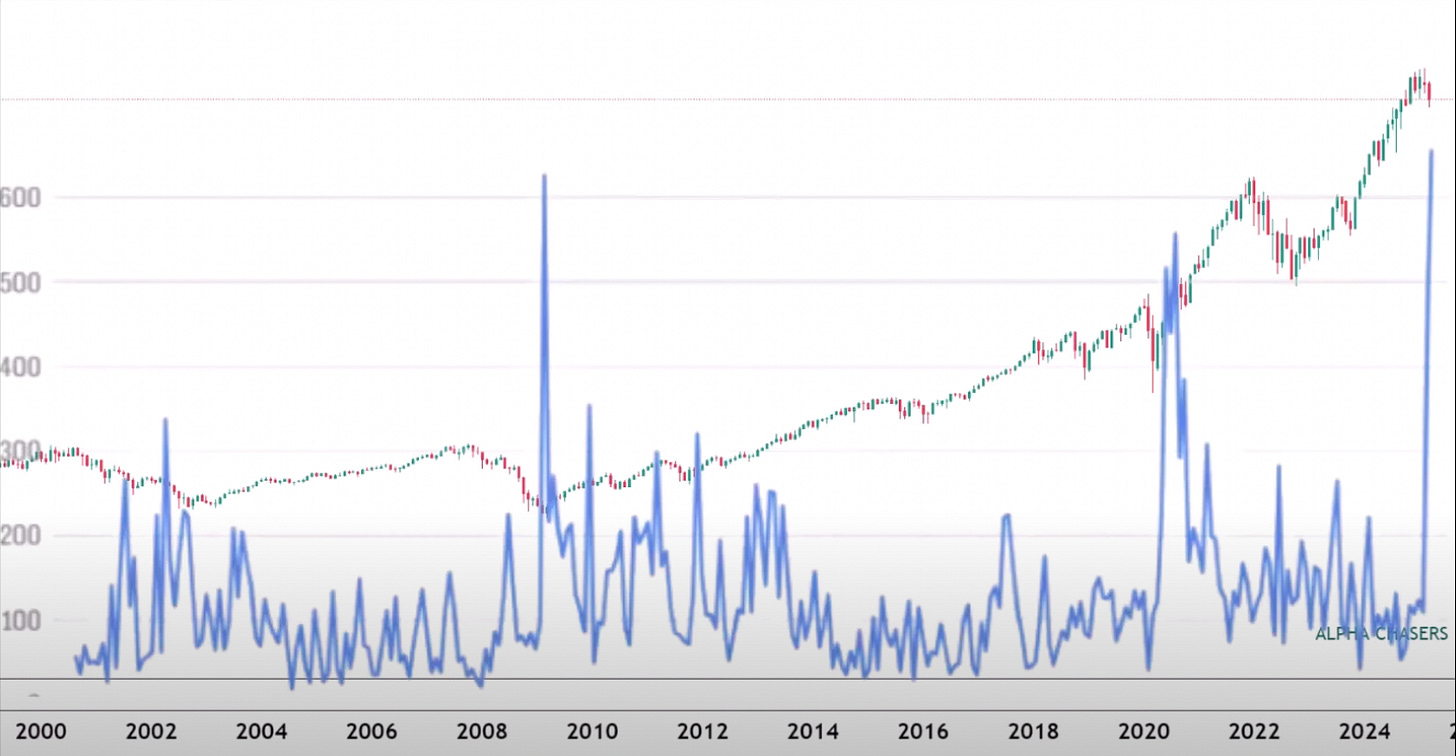

One tool that I’ve been looking at that I found helpful is the US Economic Uncertainty graph vs. the performance of the S&P 500.

Reviewing Historicals Puts Things in Perspective

You can see that we are at our highest reading on economic uncertainty right now.

When looking back at previous times we reached elevated levels of uncertainty, these were near bottoms. It may not call it perfectly, but you can see the correlation.

For example, you can see that 2002-2003 was a great buying opportunity. The Great Financial Crisis in 2008-2009 was a great buying opportunity. The COVID pandemic was a buying opportunity.

The point is that we don’t get opportunities with significant uncertainty very often, so when we do, we need to make sure that we take advantage of them.

That isn’t to say that it’s wise to go all-in on the market, but being aware that buying opportunities may present themselves shortly is prudent.

For more on this and additional research on a potential market bottom, watch this video: