Watch this Sector

With earnings coming out from Ralph Lauren ($RL) and the stock making an outsized move both after hours and during trading yesterday, a light was shone on the consumer discretionary/specialty retail sector.

Let’s dig into why we are seeing strength in this sector.

My Hypothesis

After doing some research, there are a couple things that stand out that could explain why this sector is moving.

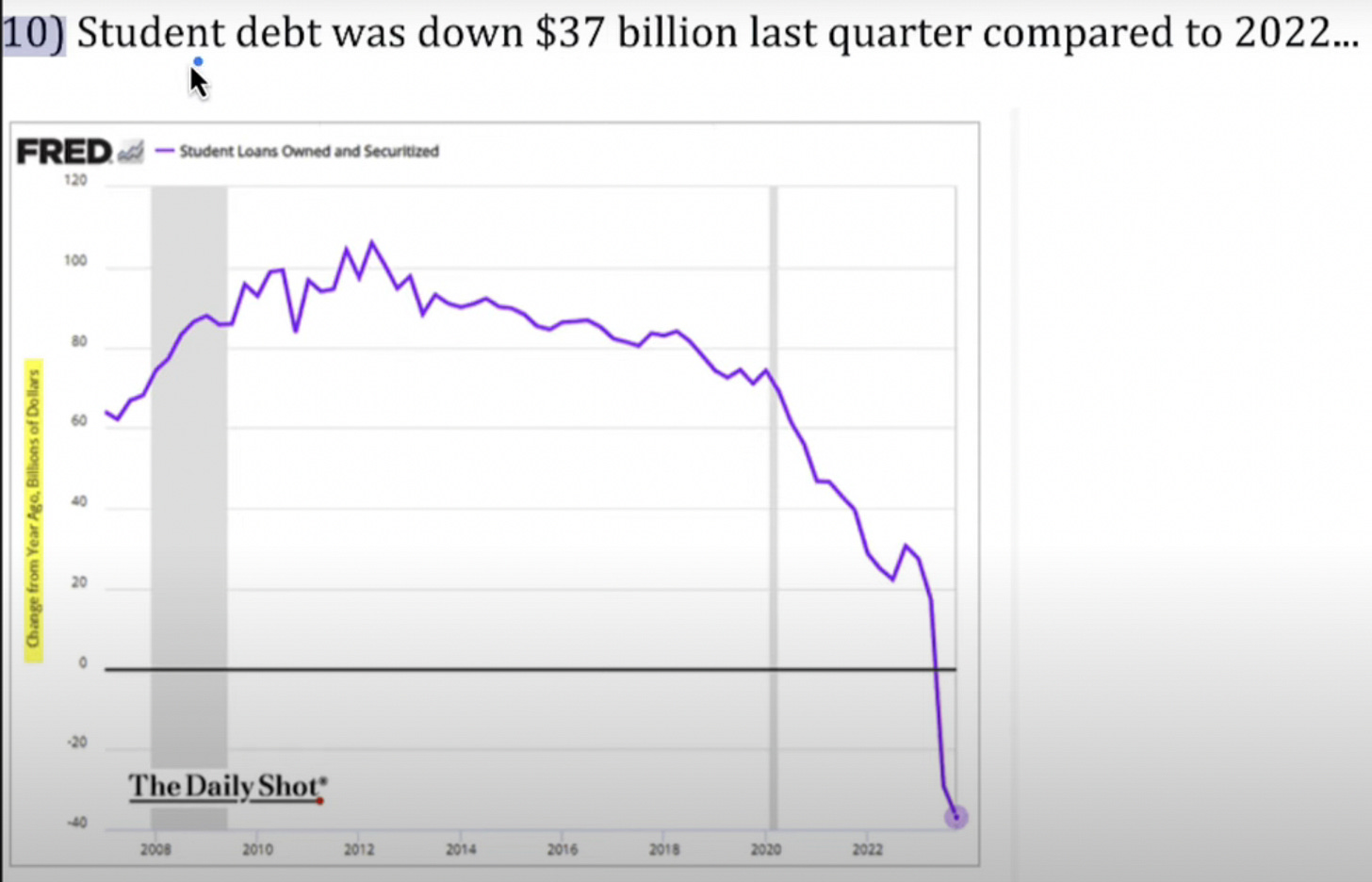

Student loan debt has dropped significantly in the last year. With less debt, consumers have more money to spend at their leisure. Therefore we are seeing increased spending at companies like Ralph Lauren, American Eagle ($AEO), and Abercrombie & Fitch ($ANF).

It is not only student loans that are declining. Additional types of loans are seeing the same trend. Above shows automobile loans also declining significantly in the last year.

This is important to understand and can fuel long-term growth for consumer discretionary ($XLY) names.

I cover this more in-depth in my video below:

My take on debt coming down shows the consumer spending is slowing ie they are not taking out new loans to buy (upgrade) on larger purchases rather are buying “more affordable” luxury items like $110 polos that are marketed 40% off (visit website for sale) either way strong start need to be ready for so breathe banking situation at end of Qtr will be interesting