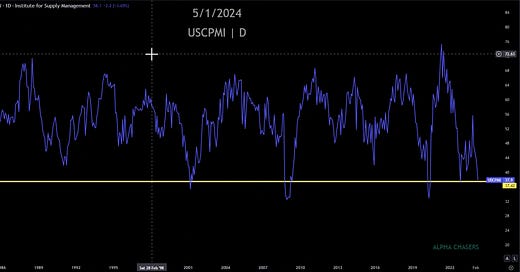

Chicago PMI

The first thing to understand is that Chicago PMI is falling off a cliff. Chicago PMI measures manufacturing and whether we are seeing expansion or contraction of manufacturing.

You can see that we are reaching levels equal to what we saw during the Great Financial Crisis and the dot com bubble burst.

This signals that corporate profits will drop, and is recessionary. This is spooking the market.

Rate Cut Probabilities

Let’s look at rate cut probabilities and how it has changed.

You can see that we have a 17.5% chance of a cut in July, up from 10% two weeks ago.

What could be the reason for this?

Non Farm Payrolls

There are rumors on the street of what is going to come with Non Farm Payrolls on Friday.

There is belief that past NFP prints have been incorrectly inflated, and that job growth is actually much lower than previously reported.

This signals that the economy may be slowing and not as hot as we thought, which increases the likelihood of rate cuts.

Take a look below for the rumors on the street:

I expand on the macro environment and what it means in terms of stocks you should be buying in this video: