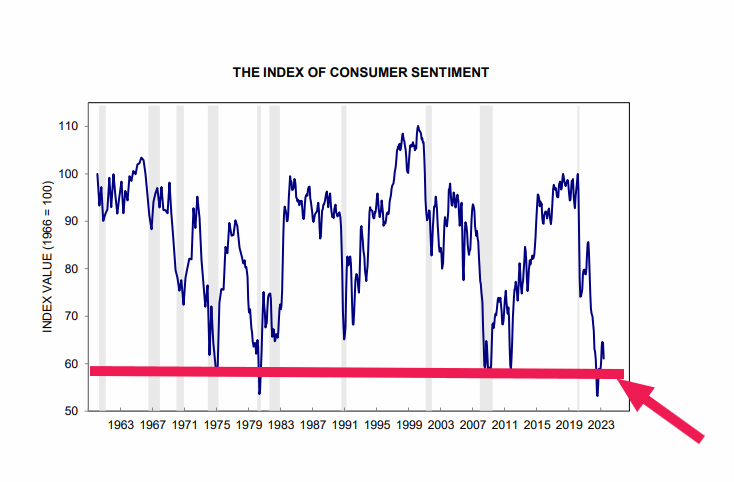

📈Weakening Consumer Stocks a Concern?

It started on Friday with Michigan consumer sentiment coming down lower than expected to a level only seen 5 times in 50 years. The reading of 57 versus the estimate of 62 was the first signs of a cracks in the consumer. The economic data indicator tells us how consumers feel about the economy and their job prospects. This leads us to understand their willingness to consume. From the chart below you can see we are at one of the lowest readings since inception of the indicator.

More troubling was retail sales. Retail Sales Year over Year (Apr) actual was 1.60% versus 4.20% estimate and previous 2.42%. Retail Sales (Month over Month) (Apr)actual was 0.4% versus 0.8% estimate and previous -0.7%. The chart below is a snapshot of retail sales since 2021. The last negative reading was the pandemic.

Companies are starting to show a weak consumer in their results.

Home Depot missed its revenue projections and stated that its lowering FY23 Outlook: Sales And Comparable Sales to Decline 2% - 5% Vs. $156.56B Estimate, EPS Decline 7% - 13% Vs. $15.74 Estimate.

This morning Target (TGT) revenue and earnings came in better than expected but guidance significantly lower. Target stated Q2 EPS Outlook $1.30 - $1.70 Vs. $1.93 Estimate

TJ Maxx (TJX) missed revenue projections this morning and guided lower. TJX Stated FY24 Adj. EPS $3.39-$3.48 vs $3.55 Est and is lower in premarket trading.

Watch this video for a more detailed look at what are the top stock setups today and the key levels on the index. Pay close attention to what is said about the disparity in the Nasdaq and SP500.

Wishing Everyone Massive Success!