Week in Review

This past week was full of economic data that led to wild swings in the market.

Let’s review what happened and where we are going.

Economic Data

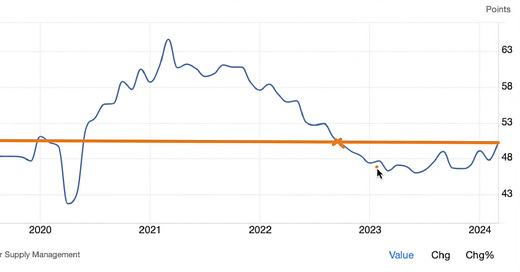

On Monday, Manufacturing PMI came out and the number came in hot. We were significantly above our previous reading as well as the consensus estimate. You can see below that we are starting to turn on PMI which is not a good sign and made the market skittish.

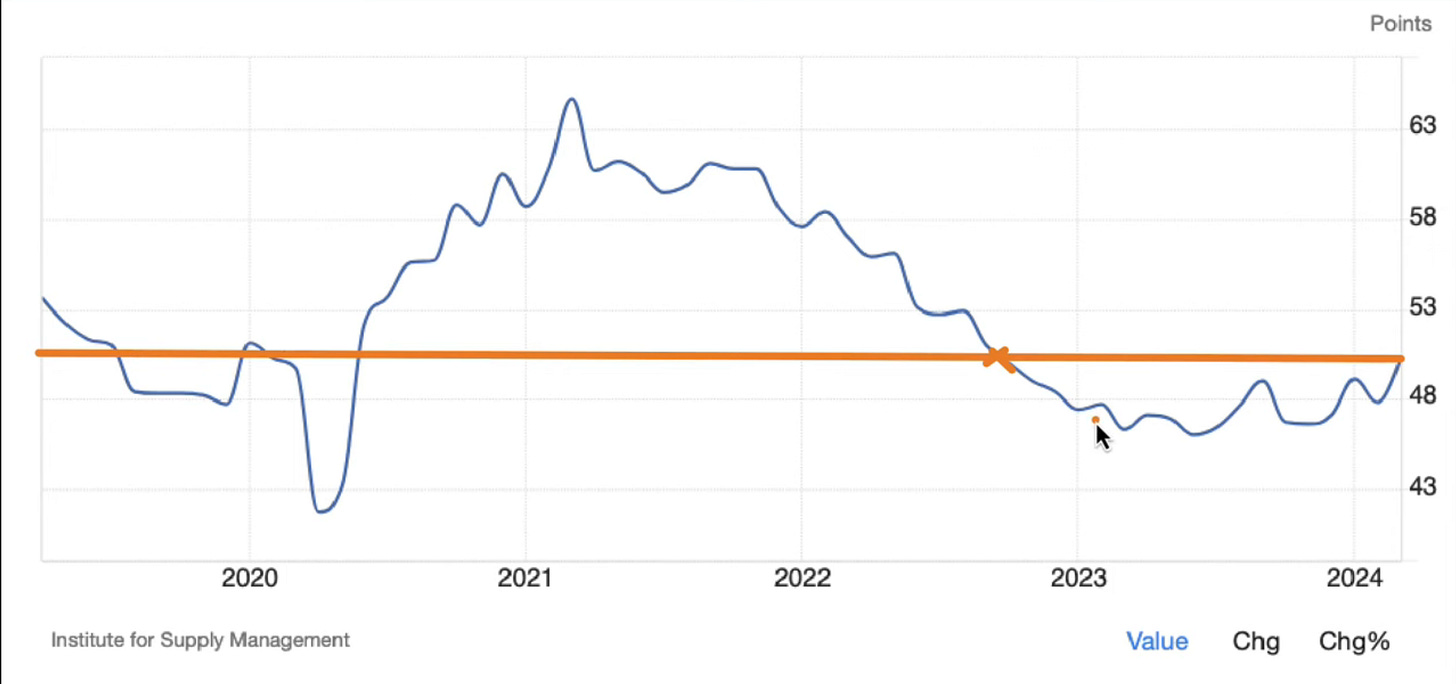

On Wednesday, Services PMI came out. This number came in well for the market - we were below expectations which is what we’re looking for. It’s a sign of a slowdown in the economy which could warrant rate cuts which is exactly what we’re looking for.

On Friday, Non Farm Payrolls came out. This was arguably the single most important piece of data that we received this week. We came in significantly above estimates. This means that we added significantly more jobs than anticipated, signaling a hot economy.

You can see that we were dropping for a while which is good, but we are now rising again and hitting highs over the last year. This is really important to understand because if we continue adding jobs at this rate, we cannot cut interest rates.

Note that we have CPI coming out this Wednesday which will be our next test of the strength of the economy and whether we should expect to see rate cuts soon or not.

Watch this weekend’s video for more details on stocks to watch and how to think about the market right now: