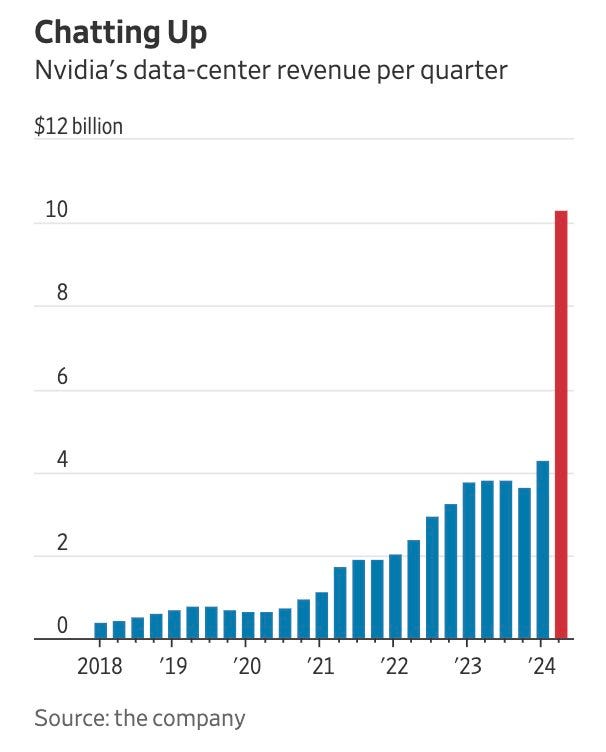

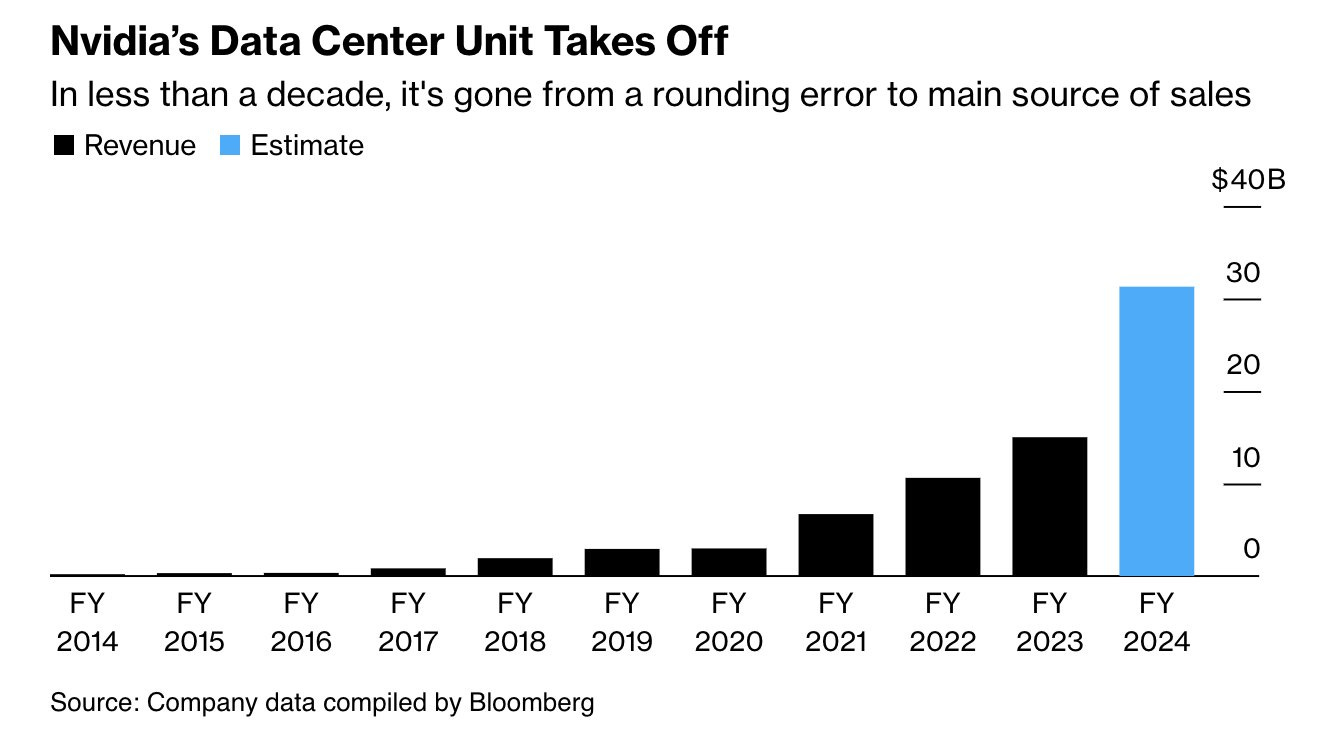

The markets were volatile after NVDA beat revenue and earnings expectations and the Jackson Hole speech, which roiled the markets last year, took place on Friday. NVDA's earnings were a blowout, with the company beating its revenue target by $2 billion on the quarterly estimate and raising earnings overall for the year. The high end on guidance for the next quarter was $15 billion, and they came in at $16 billion. This is a huge jump for any company, but for one trading at a trillion dollar valuation, it is unprecedented in history. The stock rallied substantially to all-time highs before coming back to earth.

Jerome Powell's speech on Friday was as expected with some surprises. In the speech, he openly admitted that the Fed's actions are restricting economic growth, hurting wages, and the employment market. He also stated that they have sold a substantial amount of their holdings. Here is the most important paragraph of the speech:

"As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk management considerations are critical...we will proceed carefully as we decide...we will keep at it until the job is done"

Let’s get to the charts.

SP500 ($SPY) closed under the 12 week SMA for the second week in a row.

NASDAQ ($QQQ) second close under the 12 SMA weekly. We stayed above since beginning of 2023

RUSSELL 2000 ($IWM) remains in a multiyear base.

10 YEAR TREASURY BONDS ($TNX) highest yield since 2008

SEMICONDUCTOR SECTOR ($SOXX) is MACD rolling at the same level we topped previously.

ENERGY SECTOR ($XLE) sitting on its downward trend line(DTL) and MACD curling.

FINANCIAL SECTOR ($XLF) rolling at the DTL and MACD rolling.

DISNEY STOCK ($DIS) is at a 9 year weekly closing low.

WORKDAY STOCK ($WDAY) released solid earnings and holding the 12 SMA weekly.

NVIDIA STOCK ($NVDA) 12 SMA flipped back over. Also we have a MACD cross.

TESLA STOCK ($TSLA) holding the DTL rejection and MACD cross.

AAPLE STOCK ($AAPL) rolled back into the base and bearish MACD cross

AFFIRM STOCK ($AFRM) MACD is crossing the zero line for the first time.

NVIDIA ($NVDA) DATA CENTER QUARTERLY BREAKOUT

NVIDIA ($NVDA) DATA CENTER ESTIMATE FROM 0 TO OVER 30 BILLION IN 10 YEARS

COMPARISON OF DATA CENTER REVENUE OF INTC AMD NVDA

NVIDIA INCOME STATEMENT 2024 (credit to app economy insights)

JENSEN HUANG CEO OF NVDA CONFERENCE CALL COMMENT

Watch this video for a clear understanding of what key levels to watch on the indexes and what stocks look ready to move next week.

Wishing Everyone Massive Success!