📈What Happened in Stocks in 20 Charts

Last week we received a ton of economic data that shows clearly that inflation is coming down.

CPI and PPI data was as follows:

CPI Core Inflation Rate MoM OCT 0.2% actual 0.3% estimate

Core Inflation Rate YoY OCT 4% actual 4.1% estimate

Inflation Rate MoM OCT 0% actual 0.1% estimate

Inflation Rate YoY OCT 3.2% actual 3.3% estimate

Core PPI MoM OCT0% 0.2% 0.3%

Core PPI YoY OCT 2.4% actual 2.7% estimate

PPI YoY OCT 1.3% actual 1.9% estimate

PPI MoM OCT-0.5% actual 0.1% estimate

Based upon the CPI and PPI release the chances of a rate hike plummeted. The chances of a rate hike on December 13th were 29.9% 30 days ago. Now they are .2%. This is a dramatic shift and will cause major asset class restructuring. Let’s Look at the charts!

Apple ($AAPL)

Crude Oil Futures (CL1!)

Dow Jones Industrial Average ($DIA)

US Dollar Index ($DXY)

Google ($GOOG)

Russell 2000 ETF ($IWM)

Microsoft ($MSFT)

Netflix ($NFLX)

Nvidia ($NVDA)

Nasdaq 100 ($QQQ)

Semiconductors ETF ($SOXX)

S&P 500 ($SPY)

Tesla ($TSLA)

Taiwan Semiconductors ($TSM)

Financials ETF ($XLF)

S&P 500 market cap concentration in top 7 stocks

The “Magnificent 7” have lifted the S&P 500 in 2023

Percent of S&P 500 companies beating quarterly EPS and sales estimates

Housing vacancy rates

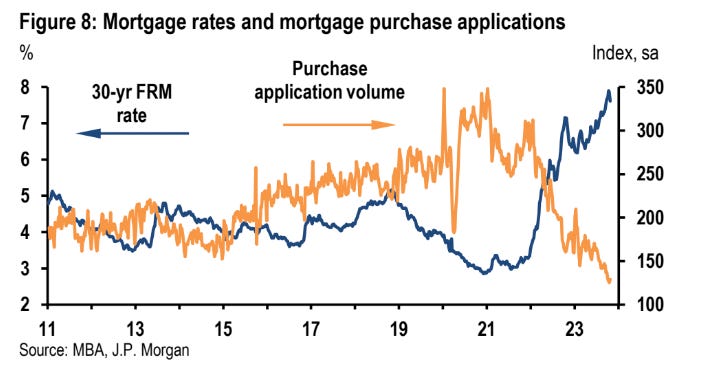

Mortgage rates and mortgage purchase applications

Watch this video for a look at 4 indicators that all gave major signals in the past week. The last time this happened was the late 1990s