📈What Happened In Stocks in 20 Charts

CPI and PPI came in lower than expected this week. The core CPI estimate was 5.2%, but the actual was 4.8%. This is the first time in almost two years that we have a core CPI below 5%. On Thursday, PPI came down to 0.1% month over month, versus the 0.2% estimate.

It is hard to see a scenario where the Fed continues to raise rates with inflation dropping faster than estimated. The next Fed meeting is on July 26th, and there is a 90% chance of a rate hike. However, the chances of a rate hike after July have dropped precipitously.

This week starts earnings season, with 12% of the S&P 500 reporting. Both Tesla and Nvidia report, and they will be watched closely. Let's get to the charts.

SP500 ($SPY) makes another new weekly high as the buying of more sectors continues to broaden out. Moving averages are widening(bullish)

Nasdaq ($QQQ) breaking out of a small base and very little resistance until the previous highs.

Russell 2000 ($IWM) has been basing over a year. MACD is curling up through the zero line which is bullish. All three moving averages (12,22,52) are crossing.

Semiconductor Sector ($SOXX) stopped at resistance ($518) after breaking out of a flag.

Financial Sector ($XLF) continues to base under the downward trend line (DTL). MACD is still under the zero line. We would like to see that change soon.

Microsoft($MSFT) saw huge call volume last week near the all the time high. We have only seen this level of call buying 8 times in the past two years

We saw growth sold this week and dividend and earnings yield bought. This shows a flight to safety. Its worth paying attention too.

Earnings season has started. 12% of the SP500 will release earnings this week followed by 40% July 28th.

Crude oil is seeing a resurgence. Currently the futures market was expecting $73 a barrel by mid 2024. Goldman Sacs raised their estimate to $93 a barrel.

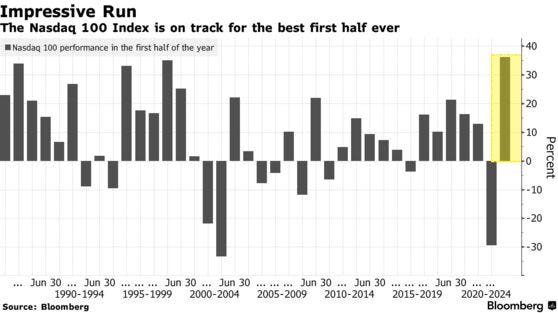

Nasdaq logged its best first half of the year.

High end retailers have consistently outperformed the S500 for 2023 $LVMHF $HESAY

Ferrari continues to outperform the high end retailers. High ticket items and the reopening of China is fueling demand. $LVMHF $HESAY RACE

Wants versus Needs continues to outperform. Highly unlikely in a recessionary environment. XLY /XLP

Bitcoin has massive selling on Friday. The rumor is the U.S. sold some of the Bitcoin seized from silk road seizure. We broke the 22 SMA for the 1st time since this rally.

Industrial Sector (XLI) making all time highs. Usually this does not happen ahead of a recession.

The U.S. Dollar is breaking down which causes goods to be in demand overseas. The 55 SMA on the weekly is rolling over.

NYSE composite with a curling up 200 SMA and the McClellan summation oscillator is set up to get over zero line.

New issue IPO’s are starting to push higher. (IPO) is attempting to get through the MACD zero line and hold all three moving averages.

Watch this video for a look at a new sub sector with several stocks set to break out.

Wishing Everyone Massive Success!