The indexes reversed after starting the week off down as pension funds rebalanced their portfolios. By the end of the week we saw buying after economic data came in showing that inflation is dropping more than expected. PCE year over year crashed from the 4.6% estimate to 3.8% . This is a huge beat and shows that inflation is becoming a non factor. The CME is currently predicting a 86% chance of a rate hike and while this may happen I do not think it is that clear of a decision. The Fed has raised rates faster then any time in history. There is no hurry now and as Jerome Powell said this week “ the next hikes may be more unpredictable then anticipated.” Overall we saw broad based buying especially in AI names, speciality retailers and the homebuilders. Let’s take a look.

SP500 ($SPY) new 15 month closing high with support now being $431

Nasdaq ($QQQ) with a bullish engulfing pattern under major resistance of $371

Russell 2000 ($IWM) has been in the same trading range since 2022. Most important is the lower highs and higher lows which means we are getting tighter.

Semiconductor Sector ($SOXX) is back above major support of $500 and forming a bull flag. RMBS AVGO both look solid.

Financial Sector ($XLF) is holding support but we have a bear pendant and still below downward trend line(DTL)

Apple ($AAPL) breaking out of all time highs after basing for almost 2 years.

Tesla ($TSLA) continues to eat up supply under $264 but still under the major downward trend line (DTL)

Nvidia ($NVDA) forming a bull pendant on the weekly chart.

Ferrari ($RACE) making all time highs again.

Overstock ($OSTK) first weekly close above the 55 SMA in 20 months.

Nasdaq relative to SP500 ($QQQ/$SPY)building a bull flag.

SP500 relative to Gold ($SPY/$GLD) breaking out of an 18 month downtrend.

Wants versus Needs ($XLY/ $XLP) are at a 16 month high. Specialty Retail items are leading.

Homebuilder sector ($XHB) makes an 18 month high and clears a Key resistance area.

China High Yield Property Default Rate is 60% which is 2X the Asia High Yield Default Rate.

National home prices are rising for the first time in 18 months

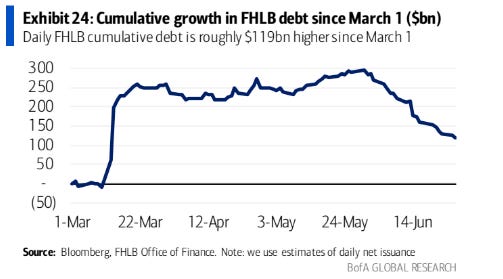

Regional Banks are borrowing less from the FHLB

Rents in NYC are continuing to rise.

Strategic Petroleum Reserve (SPR) -mn barrels is at lowest levels in 40 years

Watch this video for more stock ideas. Play close attention to RACE and ELF and the levels.

Wishing Everyone Massive Success!

Very useful charts, thank you. Not sure about inflation being a non-issue though, 3m annualized core pce/cpi have been flat at 4.5 to 5% for 12 months now. Anyway let’s follow price.