The Fed paused and did not raise interest rates after 10 consecutive raises. The halt came after the fastest interest rate hikes in U.S. history. The pause was expected but the speech was confusing. While they paused Jerome Powell stated that they may need to raise rates 50 basis points by the end of the year. This led one reporter to ask the question why not raise now. Powell was visibly uncomfortable on this call which is different than normal. His answer was based on timing and letting what they did already sink into the economy. Larry Summers summed it up best saying “I don't really understand the internal consistency of an approach of pausing at this meeting, but then signaling two further rate hikes down the road” The bond market movements agreed with Summers not Powell. Overall the indexes look healthy but due for a pullback based upon several factors. AI stocks are still leading and will be the driving force of this bull market for years to come. Let’s get to it.

SP500( $SPY) made another new closing high and we are seeing the breadth widen.

Nasdaq ($QQQ) has essentially erased all of 2022 losses. Current resistance is $370.50

Russell 2000 ($IWM) continues to build a base and closed above the 200 SMA on the weekly chart.

Semiconductor Sector ($SOXX) closed above $500 for the first time in almost two years.

Technology Sector ($XLK) made an all time high and is clearly leading the SP500.

Energy Sector ($XLE) continues to hold the major support level but the RSI is rolling which is bearish.

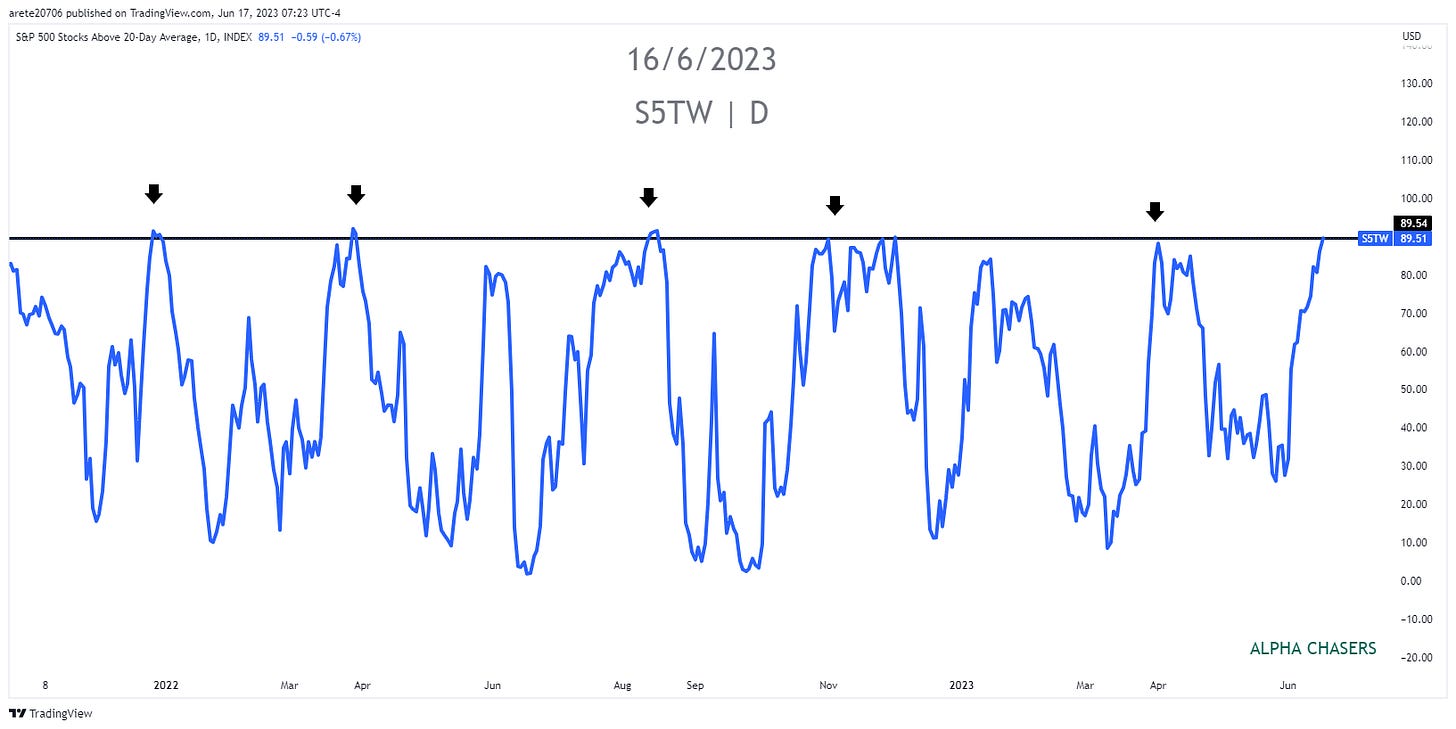

SP500 stocks above 20 day moving average on a percentage basis. 90% is excessive on average.

APPLE ( $AAPL) making and all time high and breaking out of a 2 year base.

Oracle ($ORCL) all time highs on excellent earnings and AI prospects. Now its flipping the upper channel.

Tesla ($TSLA) has 5 weeks of higher highs with the volume increasing. $315 is major resistance.

Adobe with solid earnings report and AI products that led to massive buying. $542 resistance.

Walmart ($WMT ) making a new 52 week high despite its competitors down on average since the pandemic.

J.P. Morgan ($JPM) has held up well considering the uncertainty around rates. $143.25 is major resistance.

Industrial ($XLI) names look ready to participate and have a positive RSI divergence.

DUSL is a 3x Bull ETF that mirrors the moves of the XLI

Advanced Micro Devices ($AMD) AI conference was the recent high of the stock and its having issues with $126.30

The July 26th next Fed meeting on interest rates now has a 75% probability of a rate hike.

But the current odds on a rate cut in December are over 45% . Clearly the bond market is confused or does not believe the Fed.

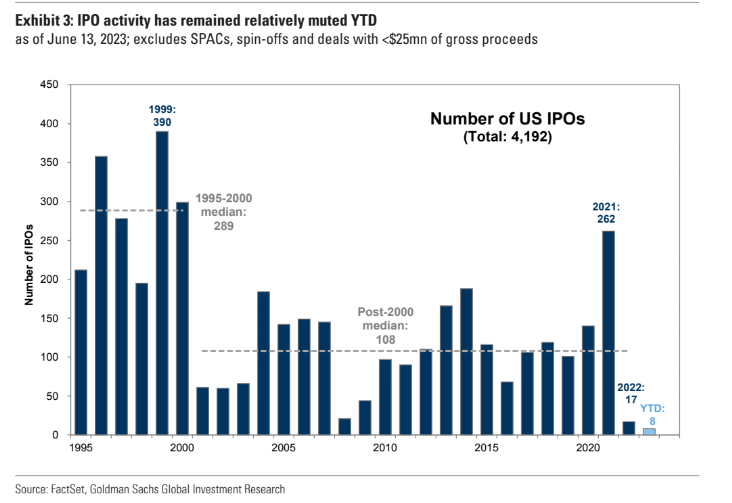

CAVA ($CAVA) the new IPO priced at $20 and doubled its first day.

Renaissance IPO ETF ($IPO) is a sign of the healthy of the public markets and access to liquidity for private companies. First higher high in two years.

Initial public offerings on average is 108 companies a year that go public via the IPO process. 2022 we had 12 and currently 8 now YTD. IPOs to market are a sign of possible froth. We are at Great financial crisis levels and no where near dot com.

Watch today’s video for a full understanding of the chances of a market correction and how steep it can be.

Wishing Everyone Massive Success!