📈What Happened in Stocks in 20 Charts

Indexes had a very hard time holding any positive gains as uncertainty around the U.S. Treasury market and the Recent Middle East turmoil added significant uncertainty to the market. Good earnings were rewarded only on a case by case basis and most were muted. Inline to poor earnings reports were punished. Let’s take a look at the charts and get ready for the week!

Google ($GOOG) sitting right on major long term support with the MACD rolling.

Meta Platforms ($META) has a clear rejection at the Downward trend line(DTL).

Tesla ($TSLA) clinging the the 200 SMA weekly and the MACD is about to cross the zero line.

S&P 500 ($SPY) sitting on major support and the MACD setting up to break the zero line.

Nasdaq ($QQQ) unable to break the DTL and MACD is getting more bearish.

Russell 2000 ($IWM) has broken the zero line on the MACD and clinging to major support

Semiconductors Sector ($SOXX) major support of $440 ahead of AMD earnings

Financial Sector ($XLF) sitting right on the 200 SMA weekly

Energy Sector ($XLE) forming a possible triple top

US Dollar Index ($DXY) holding its gains as the MACD rises.

Gold Trust ($GLD) continues to see massive inflows.

Nvidia ($NVDA) sitting on major support as MACD widens(bearish)

Dow Jones Industrial Average ETF ($DIA) rejected the recent 2022 high

Light Crude Oil Futures (CL1!) continues to struggle with $90

NYSE Composite Index ($NYA)has broken the 200 SMA weekly for the first time in over a year.

Sectors performance year to date.

As goes JPM goes the SP500, credit to 22V research

West Coast Inbound Port Traffic Growth was up 14.7% Y/Y in September, Improving from August Levels $JBHT and $UNP benefit the most

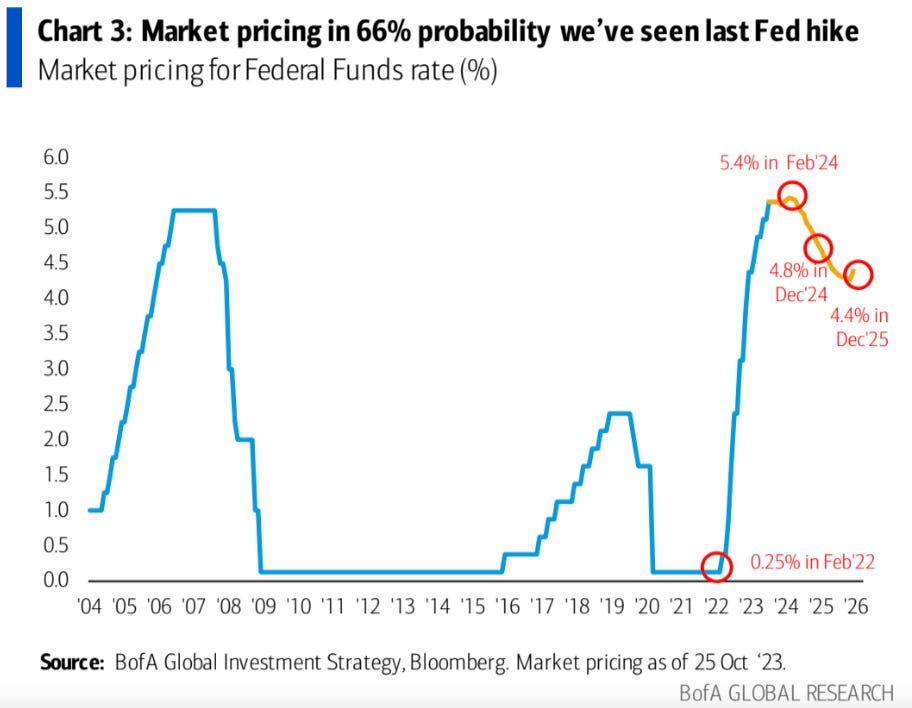

Market Pricing in 66% Probability We’ve Seen Last Fed Hike

Oil Up, Yet Saudi Market Down… Recession Signal?

Watch this video for a detailed understanding of what is happening to the U. S. equities markets and how to profit from it.

Wishing Everyone Massive Success!