📈What Happened In Stocks in 20 Charts

What a week! It started off with META and GOOG beating estimates and raising guidance and ended with Japan making a monetary policy move that could equate to a rate hike. With over 60% of the SP500 reporting earnings overall have been better than expected. This week earnings focus will be on AAPL AMZN AMD UBER just to name a few. Let’s look at our charts.

SP500 ($SPY) Closed over a major barrier even with the weighting of Japan’s monetary policy change.

Nasdaq ($QQQ) received a push as investing in technology names broadened.

Russell 2000 ($IWM) has been basing and the RSI broke out to the buy side.

Semiconductor Sector ($SOXX) are seeing a resurgence in the equipment manufacturers which is akin to the beginning of a cycle.

Energy Sector ($XLE) continues to see inflows after Exxon and Chevron’s earnings calls last week.

Industrial Sector ($XLI) are making all time highs broadening out the SP500 rally.

Value relative to Growth (VTV/VUG) took a pause this week with investors flowing back into growth.

Communication Sector ($XLC) makes a new 52 week high thanks to META GOOG.

Technology Sector ($XLK) closing at an all time high! AAPL on Thursday

Nasdaq relative to the SP500 ($QQQ/$SPY) continues to build a huge flag.

Tesla Stock ($TSLA) rejection of a key weekly DTL continues to overhang as large automakers cut deals with other EV companies. For example VW and XPEV.

Nvidia ($NVDA) has a new weekly closing high as it consolidates inside the weekly breakout bar.

Meta Platforms($META)reverses course after reporting earnings.

Microsoft ($MSFT)is still having issues with all time highs after a blow off move.

Apple ($AAPL) is making all time highs before earnings on Thursday.

KLA Technologies ($KLAC) We had a great trade last week into earnings in the Alpha Chasers community. KLA making all time highs. Semiconductor equipment names look great overall.

Large-cap vs. Small-cap is seeing a stalling as investors start to favor smaller cap names.

Time to look at treasury bonds after the worst time in 50 years to own them?

Disposable income is increasing which is good for retail stocks ($XLY)

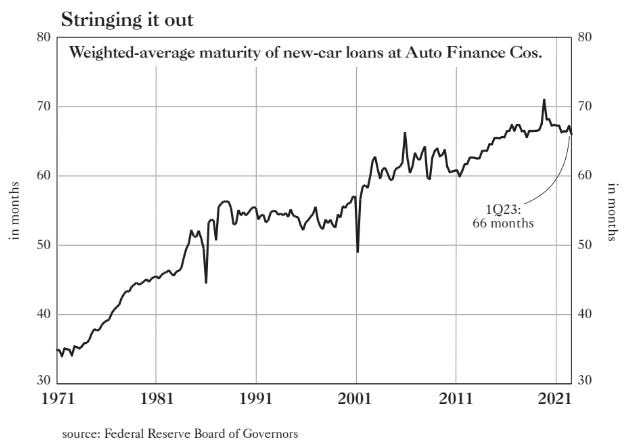

Average Car Loan is 66 months which is just mind boggling.

Japanese Bonds versus stocks inflow outperformance may be coming to an end.

Wishing Everyone Massive Success!