A volatile short week after the July 4th holiday weekend that was fueled by EV deliveries and economic data. Both Tesla and Rivian exceeded delivery orders by a wide margin fueling speculation that that both companies will deliver better than expected results. Tesla responded by gapping up $20 on Monday. Rivian is up over 45% on the week on huge volume. ADP non farm payrolls reported at 497,000 versus the 228,000 estimate. This led to a massive sell off on Thursday followed by speculation that the Friday release of the Bureau of Labor Statics Non farm payrolls would be high. It came in lower than expected and previous months were revised lower. The devil is in the details and its important to note how ANY economic indicators are calculated especially if you are going to use them in the decision making process. We reviewed Thursday night on our YouTube video that this was a possibility based upon how both numbers are calculated. As we head into earnings season we have a few charts that are telling us a lot. Let’s get to it.

SP500($SPY) holds above major support as MACD grinds higher and moving averages spread widens.

Nasdaq($QQQ) MACD presses upward as $371 stays resistance.

Russell 2000 ($IWM) uses 50% as support and the 61.8% Fibonacci level has been acting as resistance.

Apple ($AAPL) hardly gives and ground back after making new highs. Its hard to argue with a 55 SMA curling up.

Broadcom ($AVGO) consolidates in a large high tight flag. The past three weeks have stayed inside of the June 12th weekly bar.

MicroStrategy ($MSTR) makes a new 52 week high. The MACD is above the zero line and curling up.

Meta ($META) roll out of Threads has gone considerably better than expected. $300 is resistance

NVIDIA ($NVDA) sees the moving averages expand and widen as it forms a flag. The dojis on the weekly are frustrating for short term traders.

Novo Nordisk ($NVO) struggles to stay above the 22 SMA and the MACD is rolling.

Nasdaq relative to SP500 ($QQQ/$SPY) is forming a flag above the 2000 high of the indicator.

Wants versus Needs ($XLY/$XLP) sees continued outperformance. Retail names usually do not outperform ahead of recessions.

Homebuilder sector ($XHB) pushes higher as supply of homes remains historically low.

United Healthcare ($UNH) continues to roll over and money comes out of the defensive names.

RIVIAN ($RIVN) had its largest volume week in history based upon deliveries exceeding expectations.

Carvana ($CVNA) breaking out over consolidation and MACD crossing zero line for first time in almost 2 years.

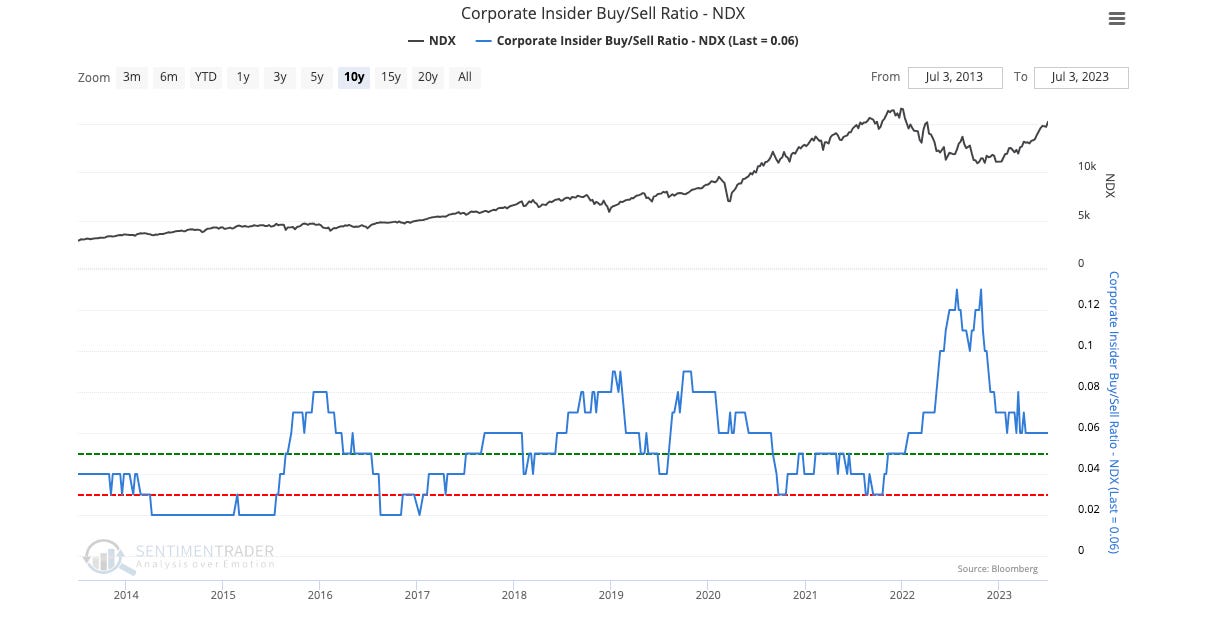

Corporate insider buying of the Nasdaq 100 names is still at an above average level after coming down from a 10 year high.

No one wants to borrow money. As demand dries up loan growth is on track to head negative.

ISM services continue to stay above 50 which is the median line and approaching 55 which is expansion while manufacturing continues to tumble.

Semiconductor earnings were revised down but multiples are rising as investors are trying to get ahead of the next up cycle.

Bitcoin best performing asset YTD while Oil is the worst

Watch this Video For What Stocks I am watching Next week and the Key levels on the Indexes.

Wishing Everyone Massive Success!

Awesome Chart work thanks!