📈What Happened In Stocks in 20 Charts

Another week, more conflicting data. Apple missed iPhone sales for the first time in years, causing massive selling on Friday. Amazon beat revenue and earnings on every sector and raised guidance. Qualcomm stated that mobile phone sales were weak, and AMD lowered third-quarter guidance. This led to massive swings and volatility.

On the bond market front, Fitch downgraded U.S. Treasury debt. While Yellen and Summers told us not to worry, I believe we should watch this closely. First, fund managers have charters that state what they may hold. Certain managers will not be able to hold AA-rated bonds. They can only own triple-A-rated bonds by all three major rating agencies. This creates a problem that was not foreseen.

Remember, it's not what we know that becomes the issue. It's what we don't know. Let's get to the charts!

SP500 ($SPY) has its first close under the 5 SMA on the weekly since the beginning of the year.

Nasdaq ($QQQ) has its first close below the 5 SMA since March.

Russell 2000 ($IWM) is the only major index above the 5 SMA on the weekly.

Semiconductor Sector ($SOXX) rejected at the top of the control bar and MACD seems to be rolling.

Energy Sector ($XLE) looks to be setting up along a DTL and the MACD crossing the zero line.

Ten Year Treasury ($TNX) breaks 4% as investors sell bonds.

Volatility Index ($VIX) has its first higher high in several months.

Apple ($AAPL) closed under its 12 SMA on the weekly chart for the 1st time this year

Microsoft ($MSFT) has a clear rejection of the all time high and closed below the 12 SMA

Tesla($TSLA) rejected the weekly DTL and is building a bear flag.

Commodity index is showing signs of a resurgence on the MACD and 55 SMA starting to curl

NYSE composite with McClellan Summation. I go into great detail in the video below.

Oil and Gas exploration sector ($XOP) starting to see support with a curling 55 SMA

Growth relative to Value ($VUG/$VTV) has its first close under the 12 SMA all year

Small caps relative to Nasdaq ($IWM /$QQQ) with its first close above the 12 SMA all year.

AAII sentiment indicator at highest level in 2 years

T-Mobile ($TMUS) surpasses AT&T ($T) in marketshare. (graph by Morgan Stanley)

Mercedes surpasses Tesla ($TSLA) as most desired car. The decline is interesting.(graph by Morgan Stanley)

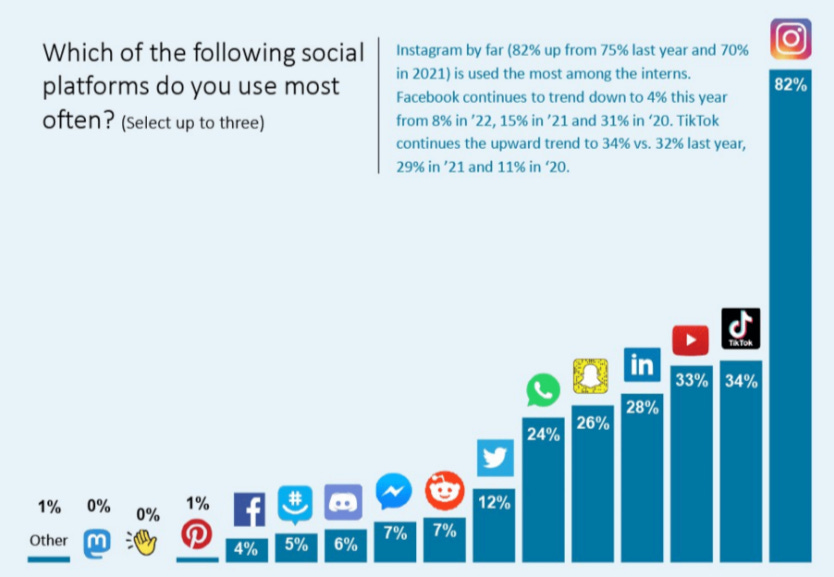

Most used platform winner is instagram ($META) by a long shot. (graph by Morgan Stanley)

Unity Software ($U) partnership with Apple ($AAPL) might not be as good as expected if 72% of those surveyed do not even want a headset with a 65% price reduction. (Graph by Morgan Stanley)

Watch this video to get a better understanding of the shift in the indexes and what to look for this week. Pay attention specifically to the Apple Chart.

Wishing Everyone Massive Success!