Last week was a difficult week for traders. The major indexes had their first down week since the Fed announced rate cuts were coming in 2024. Looking forward we are waiting to see if this is a short term pullback or if there is more selling to come.

Key charts to be aware of below:

US Dollar Index ($DXY) - RSI holding as is support

Russell 2000 ETF ($IWM) - failed yet again and RSI rolled back under 70

Microsoft ($MSFT) - huge RSI negative divergence

Nasdaq ($QQQ) - rejected the high, RSI under 70

Semiconductors ETF ($SOXX) - rejected the high

S&P 500 ($SPY) - RSI rolling under 70

Tesla ($TSLA) - multiyear DTL continues to hold

Regional Banking ETF ($KRE) - holding above major support

Cloud Computing ETF ($CLOU) - $21 major support

Health Care ETF ($XLV) - multiple year range

ZIM Integrated Shipping ($ZIM) - above the 55 SMA weekly

Cytokinetics ($CYTK) - another new high as we approach the weekend and JPM conference. Buyout rumors persist.

Bitcoin ($BTCUSDT) - forming a flag, RSI is overbought

10 Year Treasury ($TNX) - continues to hold 55 weekly SMA

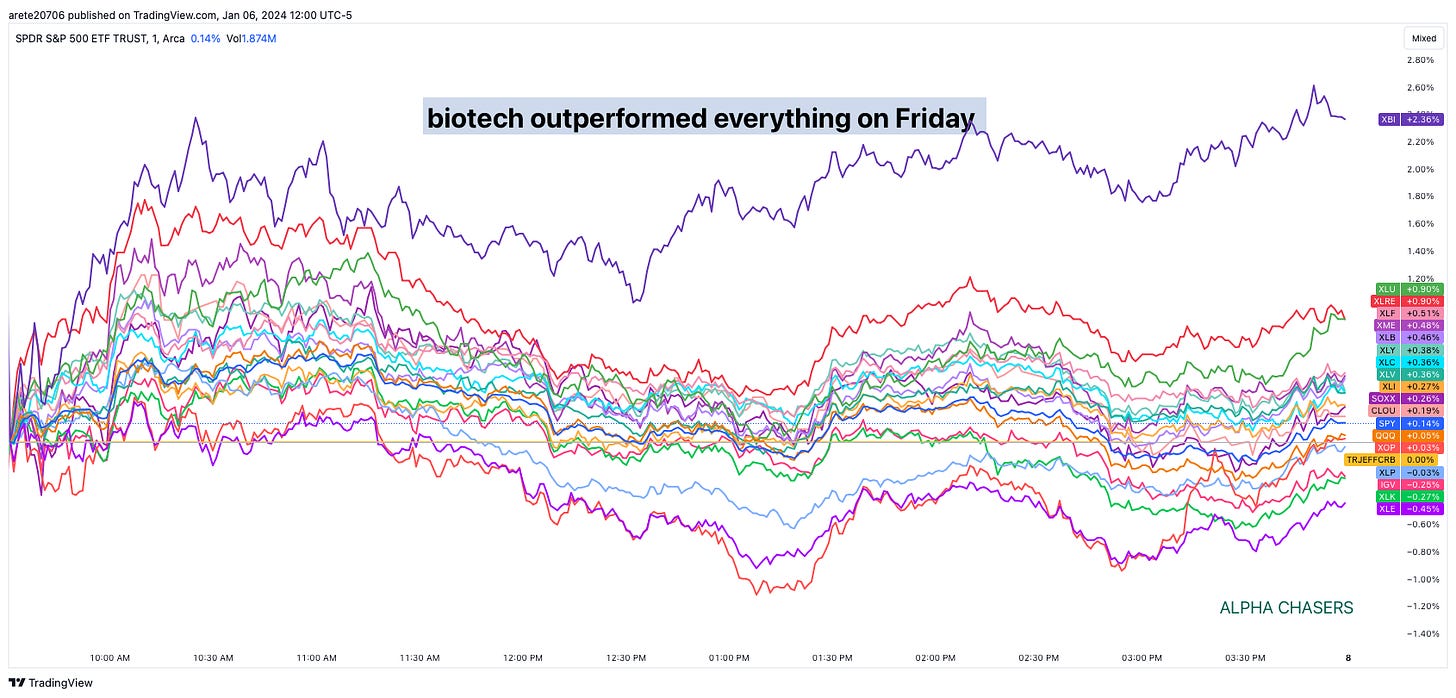

Sector comparison - biotech outperformed everything on Friday

The composition of PE dry powder

Secondaries fundraising activity

About $1.5T in private credit globally, of which $400B is dry powder

The exits-to-investments-ratio is declining

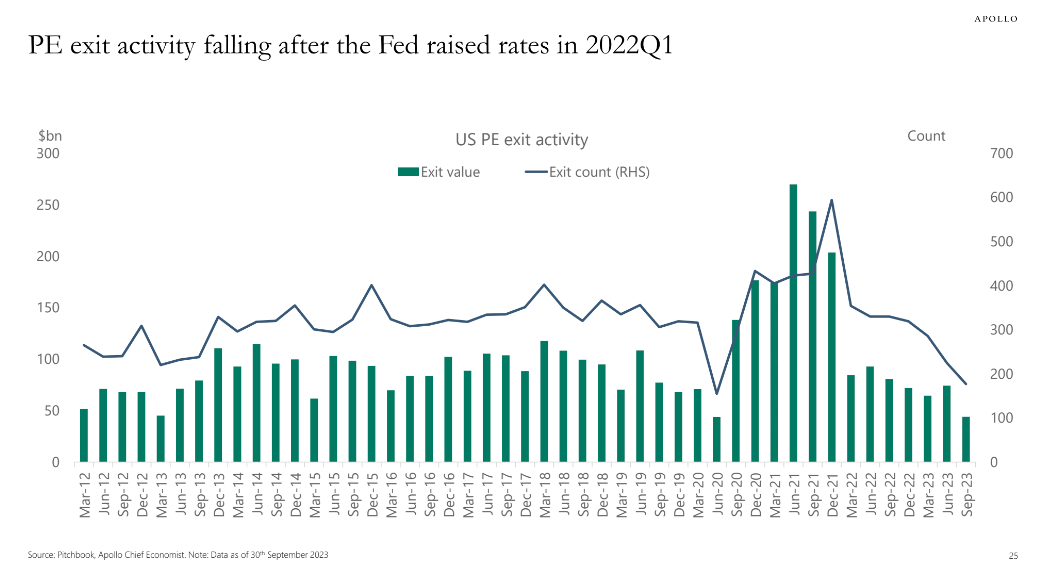

PE exit activity falling after the Fed raied rates in 2022Q1

For more stock market analysis, watch this weekend’s video: