As we close out the year I wanted to say thank you for being a member of this newsletter. It has been a great experience my first year of publication. Thank you for your support. Thank you for the emails and discussions on how this has helped inform and educate you. It’s been an honor. I look forward to several more years and taking it to the next level next year.

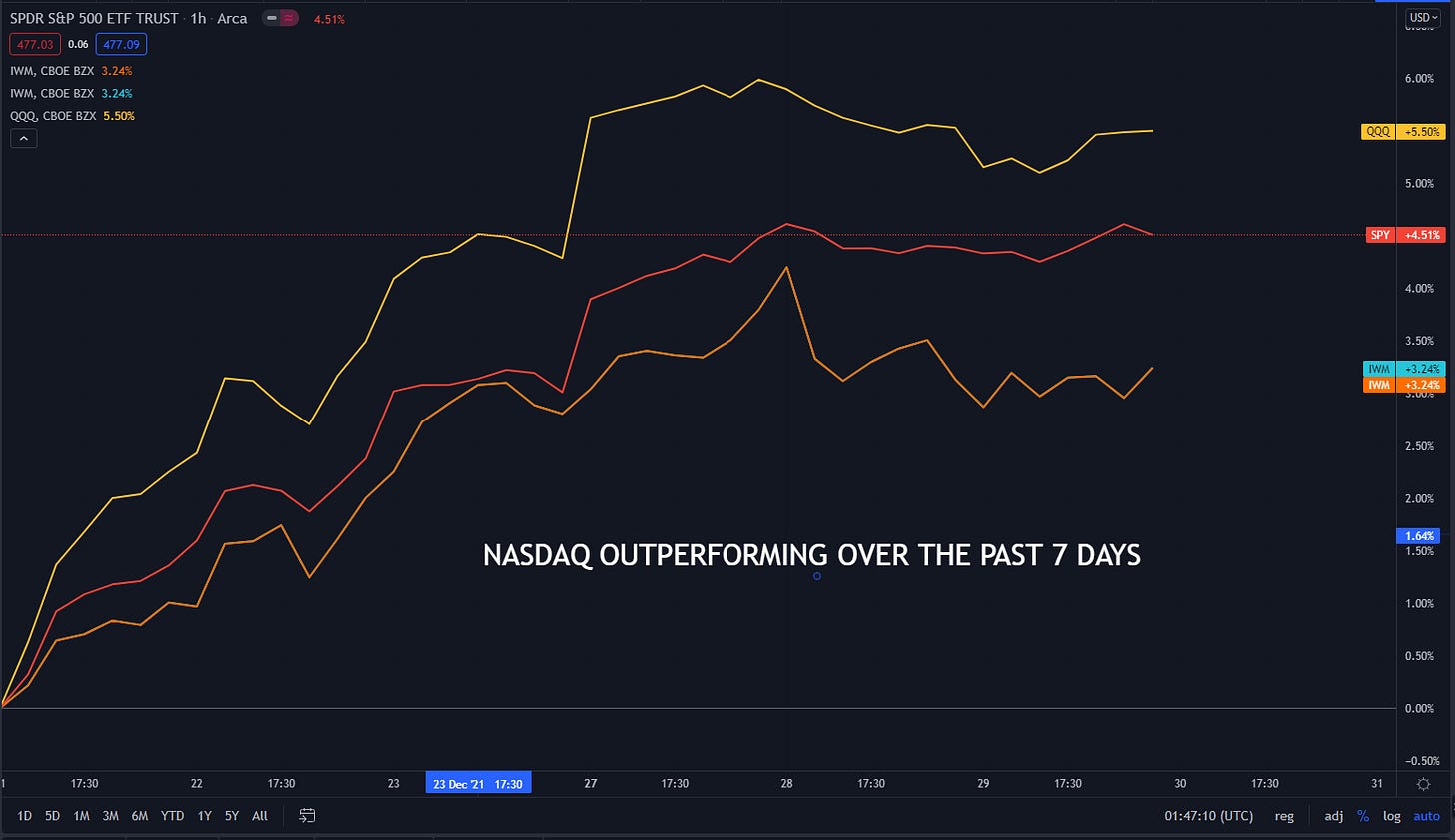

We have rallied off the recent lows that were set last week. The markets were on a tear. The IWM up over 8% from low to high is a massive move. This move was spurred by data showing the Omicron variant was not as bad as first thought. The travel laden index rocketed upwards and gave us some nice gains. The QQQ are now leading for the past week. You can clearly see the outperformance in the graph below. While the past two days we have traded sideways on the indexes, It’s healthy. Resting before going higher is exactly what we want. We do not want a frothy market. Sure they are fun and lucrative but unsustainable. We have made an all time high on the SPY and have traded above every day since. We are seeing more breadth in the market look at the percentage gain in each SPY sector below.

So what is next for 2022. To Start with the very first thing that happens is stocks that sold down on tax sales will rally. I will be putting out a video this week on what stocks to watch the first week. This will be a list of stocks that have the greatest potential to bounce. Every year this happens for the first week. Sometimes it can last more then a week. Second, Investors have a clean slate, meaning their performance is locked in for 2021 and now they focus on 2022. This leads to an increased appetite for risk. Expect wild swings the first week especially in technology names. Goldman Sacs had a statement yesterday” You could triple the average return of all hedge funds in 2021 and they still did not beat the SPY”. This means no bonuses. So expect wild swings as they buy. Why would there be swings if there is just buying? Well the second part of the tax sale equation. Stocks with massive gains will sell down the first week. Why? Investors want to lock in gains but want the extra year of paying taxes. So many high fliers will be volatile as some investors lock in gains and some institutions want in those positions. Make sure you watch tonight’s video below all 5 ideas in the video have the chance to be actionable tomorrow. You are going to want to subscribe to the channel because I am going to post my top ideas for 2022 and I am going to invest in them and monitor it weekly with updates throughout the year. This will give investors a better understanding how to manage long term positions. I plan on doing the same in the crypto space. Let’s look at our charts!

Let’s Look at our Indexes!

CONSUMER DISCRETIONARY&TECHNOLOGY LEADING THE PAST 7 DAYS

Let’s Look at our Stocks!

Subscribe to You Tube! 👈Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. Its loaded with actionable ideas. Its worth your time. It is hyper specific and actionable. Tonight’s includes 3 Longs and 2 Shorts. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. The video below is the Top 5 from tonight.

Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely. If you do not see a position and have questions please email me: ARETE@ARETETRADING.NET Wishing everyone Massive Success

Now you can share the Newsletter!

👇👇👇

Subscribe Now !

👇👇👇