Regional Banks

Regional banks saw massive buying after Powell announced upcoming interest rate cuts, but have since pulled back.

Let’s dig into what’s going on in this sector.

The Chart

Let’s start with how the index is looking.

The index is still above our key level and tested the 22 SMA and held. These are both positive signs.

Borrowing

We are seeing the amount of borrowing by regional banks through the emergency bank term funding program rising significantly.

Wouldn’t this be a bad sign? Why might we be seeing this?

Well, regional banks are able to borrow through this program at a rate of 4.94%. Fed funds is at 5.33% (see below).

So what this means is that regional banks are likely borrowing through the program to sell the money back to the Fed at 5.33%.

Therefore, they are actually profiting off of the borrowing.

Upgrades

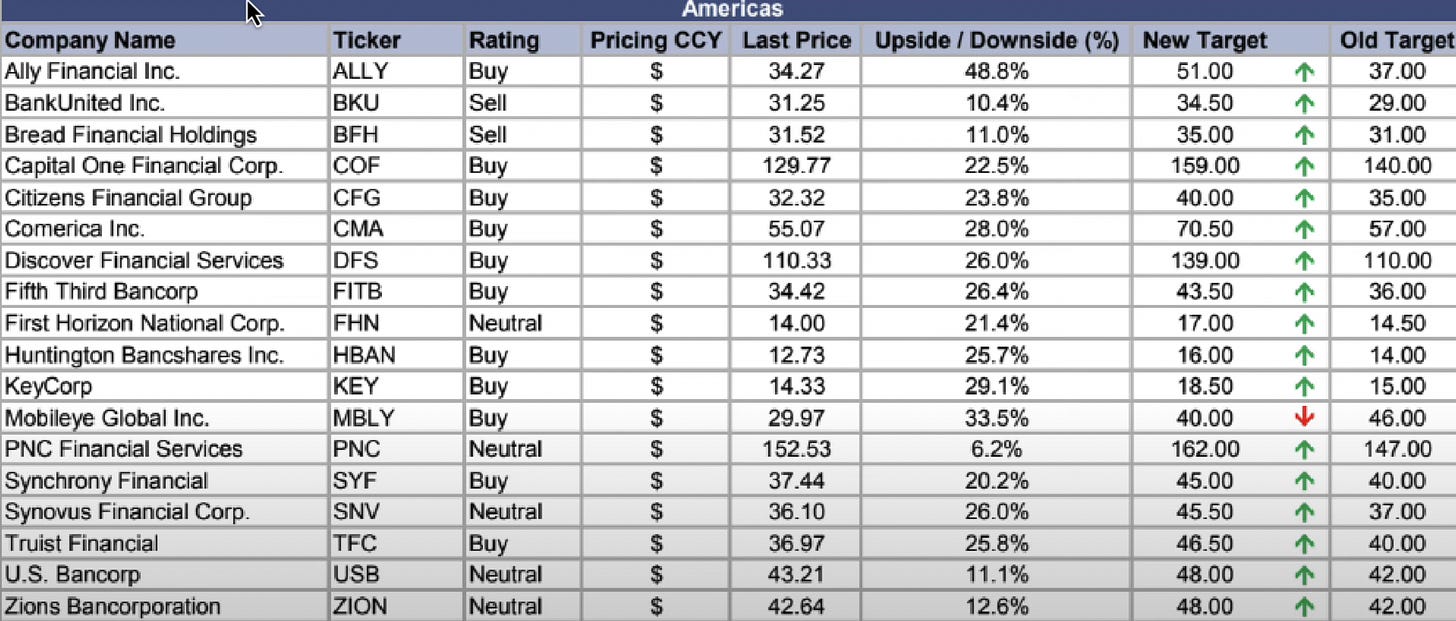

Last week, Goldman Sachs raised target prices on 17 regional banks. They even raised target prices on banks that they have sells on!

Clearly they think that regional banks will move higher.

Putting this all together, it seems regional banks are poised to move higher. For more information on regional banks, watch this 7 minute clip below: