📈Where is the Alpha?

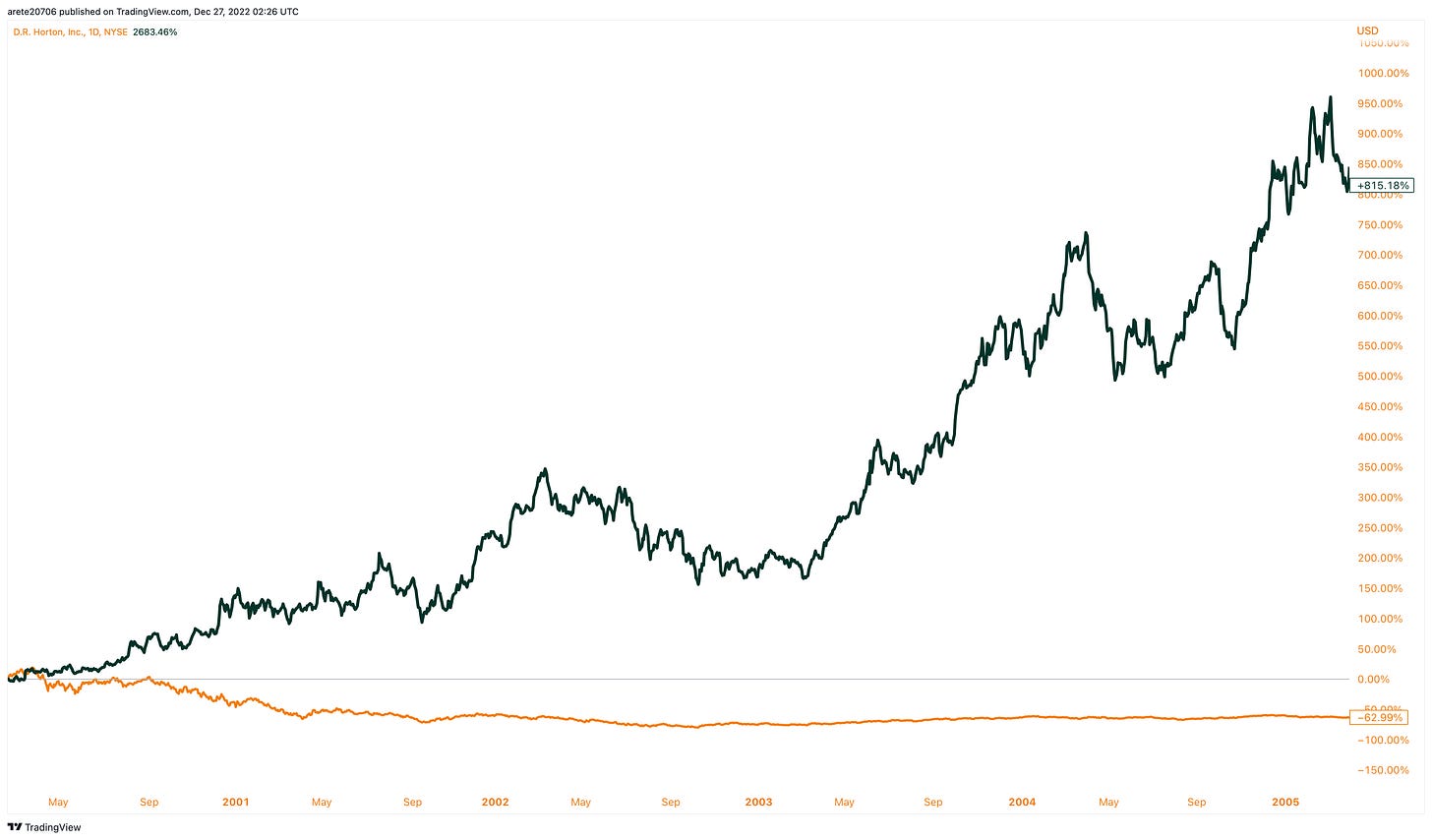

As tech declines money will flow into more lucrative areas with less risk. If we look at similar time periods of tech carnage we can see that value stocks outperformed growth stocks. For example D.R. Horton the home builder , symbol DHI, outperformed technology during 2000-2005 by a wide margin. While the Nasdaq was down over 60% in 5 years the home builder was up over 800% in comparison.

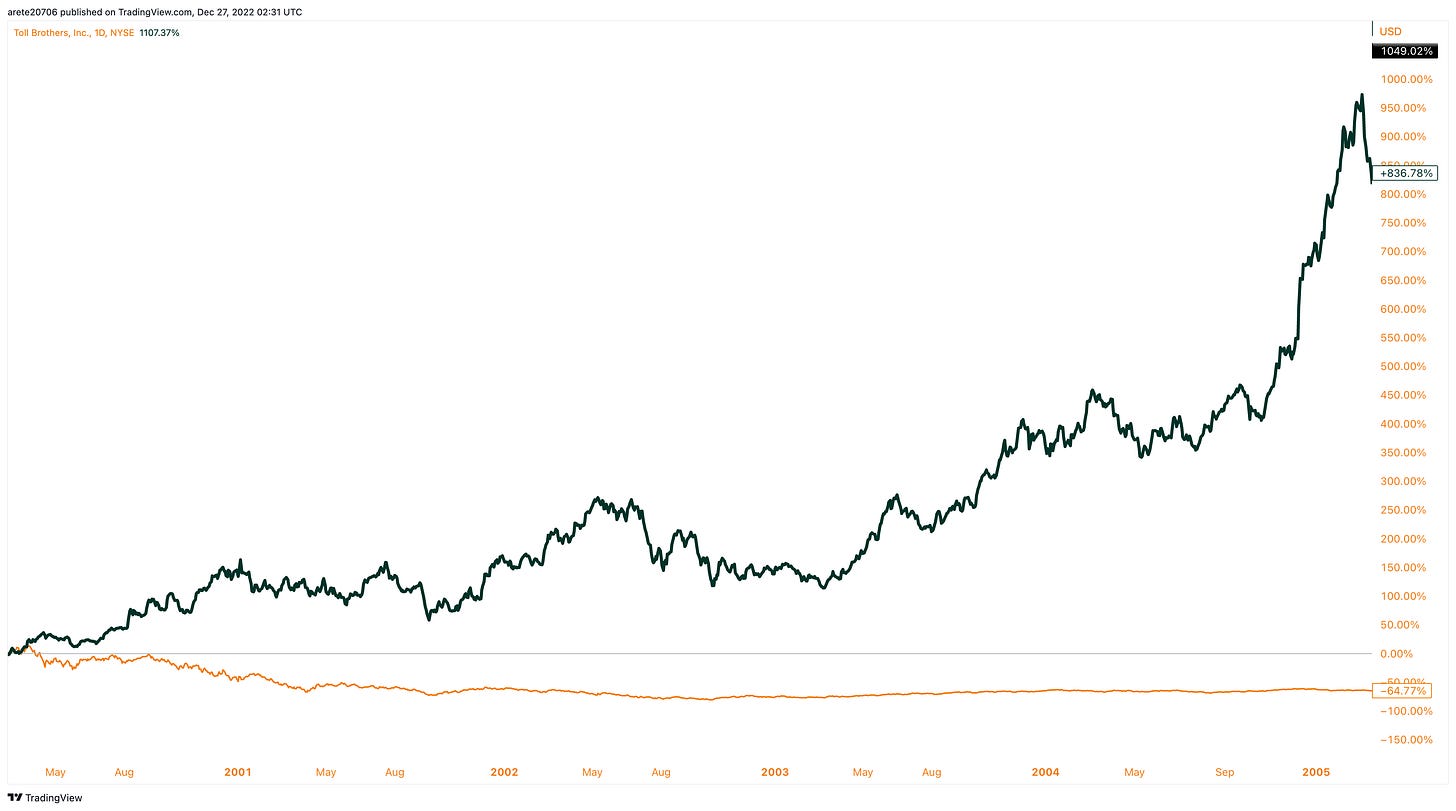

It was not a singular stock event. It was the entire sector. Toll Brother during the same period was up over 900% in comparison to the Nasdaq being down 60%

We are told that rising inventories will slow demand due to higher interest rates and that new home prices will suffer. Let’s look at that in two parts. First below is the Saint Louis Fed Index on Inventory levels in Florida. Florida is arguably the hottest market and would be expected to cool off the fastest. We are not even back to pre-pandemic inventories and mortgage rates are up over double in 2022

Mortgage rates are rising significantly faster than inventory is dropping. This is bullish for homebuilders as interest rate hikes are at unprecedented levels. The upcoming slowing of hikes will slow the rising of mortgage rates which will increase demand.

The argument that homebuilders do not rise when mortgage rates rise is simply not accurate. It depends on several factors. The two most important inventory and demand. Rising interest rates is not even a close third. Below is a snap shot of the 2003 -2005 rate hikes. Mortgage rates went from 5.25% to 6.8% during the same period D.R. Horton was up 90%

Homebuilder are not the only sector. Value overall is setting up to breakout of a 15 year downward trend versus growth. In future newsletters we will look at other sectors that flourish in this kind of environment.

Today’s Public Premarket Live Stream

Alpha Chasers Community Waitlist Click Here

1 on 1 Coaching Program Click Here

Wishing Everyone Massive Success in 2023 🍾