📈WHY FED PIVOTS MATTER

Why do Fed pivots matter? Fed Pivots are when the Federal reserve has one stance usually hawkish. Hawkish in this case refers to aggressively raising rates. The Fed then changes course and pivots to a dovish stance. Dovish means ending hikes or cutting rates.

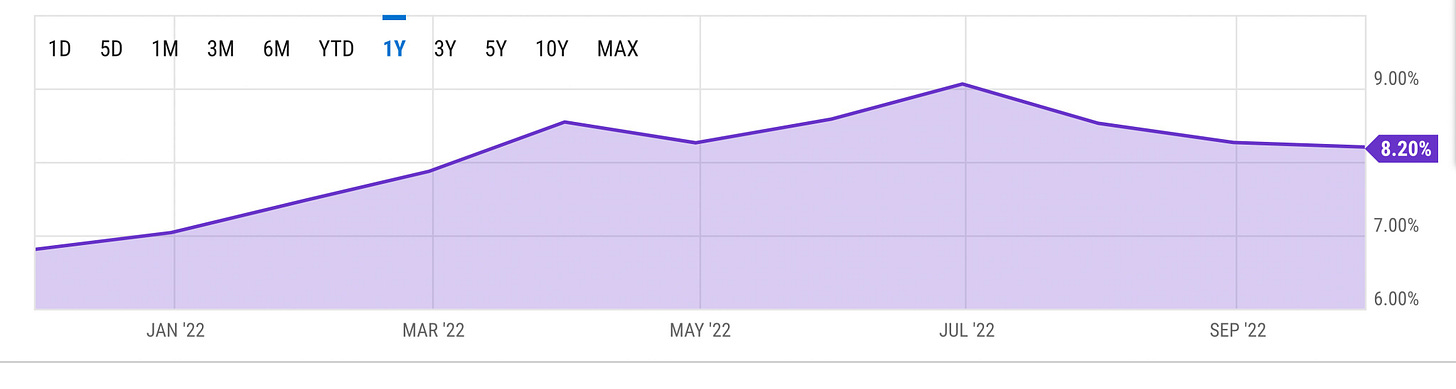

Inflation still over 8.2%

The recent non farm payrolls being higher than expected and still 100,000 over the pre-pandemic level

Powell’s comments were anything but Dovish on Wednesday and this sent the indexes down over 3% on the day with a 6.5% swing on the Nasdaq.

Based upon the three following slides you can see why thinking there is a pivot would be premature. When we see a pivot we know that we are near peak rates. This allows companies the ability to plan out further. This also lets the consumer know that mortgage rates, credit card rates and overall cost of goods will come down or stabilize. Both the company and the consumer develop a level of certainty which gives confidence. With that confidence they are more willing to spend. This is one of the reasons why the consumer confidence economic indicator is closely watched. Fed pivots can lead to significant rallies in equities. It does not happen all at once. It takes time.

Nov. 15th 1994 Greenspan raises 75 bps Feb. 1st 1995 Greenspan raises 50 bps and pivots July 6th 1995 Greenspan makes good on the pivot. Realizes he went too far and cut 25 basis points Between the pivot to the next rate hike SP500 is up over 70% in Fed Pivots are good.

March 25th 1997 Greenspan raises 25 basis points does not signal a pivot. September 29th 1998 Greenspan pivots -25 basis points June 30th 1999 Greenspan raises 25 basis points SPY is up 53% during the pivot Fed Pivots are good.

For more in-depth coverage of what stock to buy next week and a detailed review of the indexes watch the video below.

Preview the Trading Community CLICK HERE

EMAIL: Arete@aretetrading.net

Trade to Win!