What Transpired Yesterday?

We had two key factors at play yesterday that caused the market to play out the way that it did.

In the morning, we ran off of the NVDA earnings news, with the stock pushing to new highs and bringing the market with it.

However, what happened next was extremely important to understand. I do not think most traders know what transpired.

Economic Data Causes Concern

We saw some concerning economic data come out yesterday that ultimately led us to sell off.

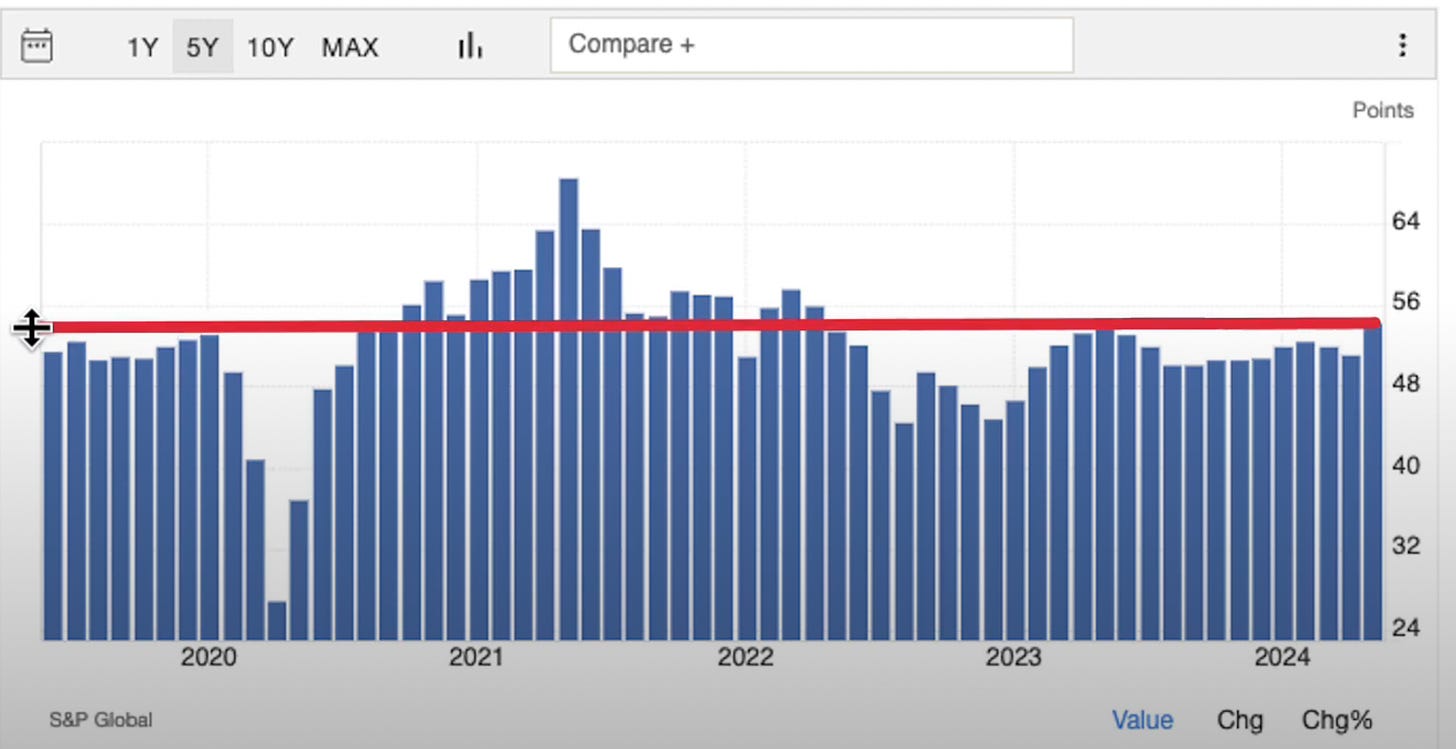

First, the initial PMI numbers came in and they were extremely hot. With PMI, you need to understand that a reading of 50 is considered neutral, with a reading over 50 signaling expansion and a reading under 50 signaling contraction.

Therefore, what we are looking for is contraction to enable rate cuts. We came in at 54.4. This is extremely high. It is the highest reading since March 2022.

This causes additional fear of inflation and skepticism around rate cuts.

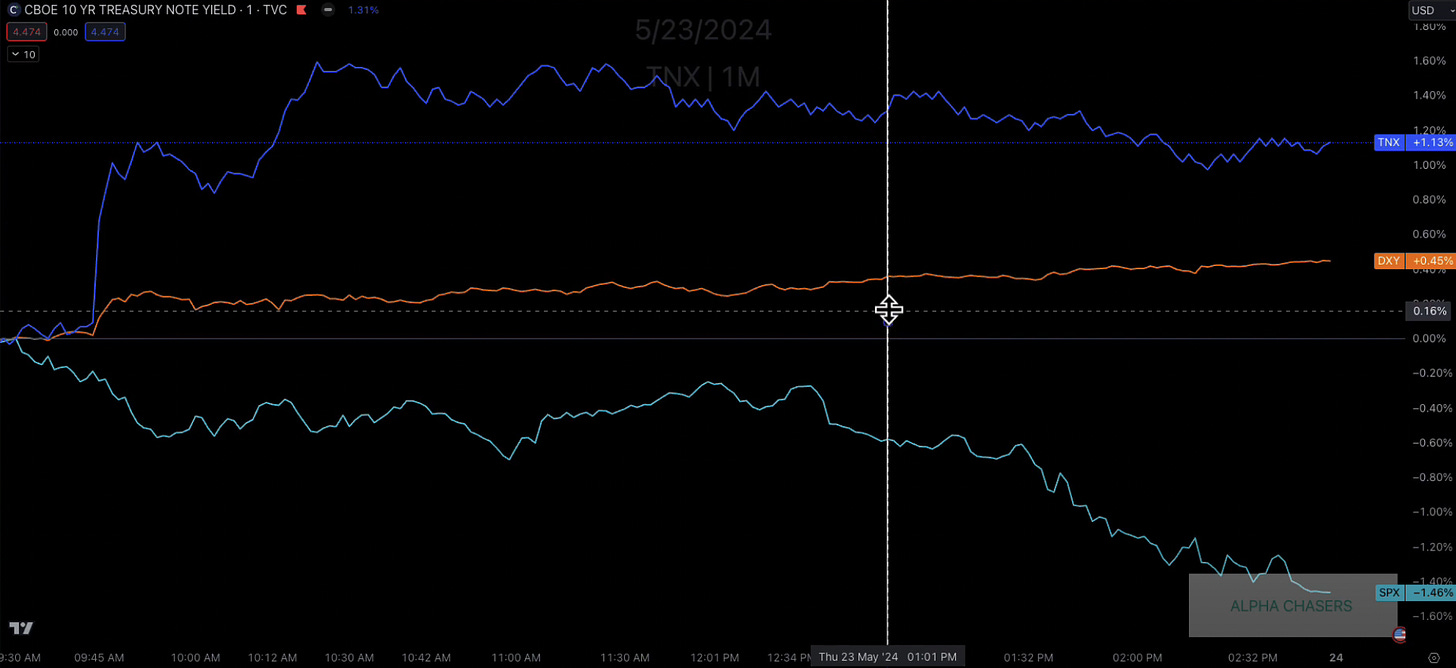

Next, we had a TIPS Auction at 1:00 yesterday. It came in higher than expected which is also bearish.

After 1:00, we sold off pretty much the rest of the day as you can see in the chart below.

For additional recap of what transpired and what to focus on today, watch the video below:

Not sure about next week, but months ahead looking bearish. The market has been slow to realize rate cuts are not coming anytime soon. Second, the justification for rate cuts by the Fed would amount to public announcement that we are officially in recession. Hence, I would rate the statistical probability of committing political suicide during an election year as HIGHLY unlikely. Conclusion, the market has a long way to go (down) before this realization has been fully priced in.(i.e. overdue for meaningful correction) Lastly, the larger time-frame cyclical TA i use for S&P500 weighs heavily on a 20 year Fib Channel showing price just rejected off a "multi-decade" upper trendline.

Great analysis, Arete! I digested the macro data release on Friday as ominously bad. However, i saw the markets irrational reaction at key levels, so I went long anyways, booked some quick profits and got out. The underlying fundaments gave me the conviction to play it safe, preserve capital. Hence, I avoided the temptation to stay in trades that just didn't make sense. I have learned to apply Macro, Fundamentals to my trading style from you, Arete. Tango Mike!